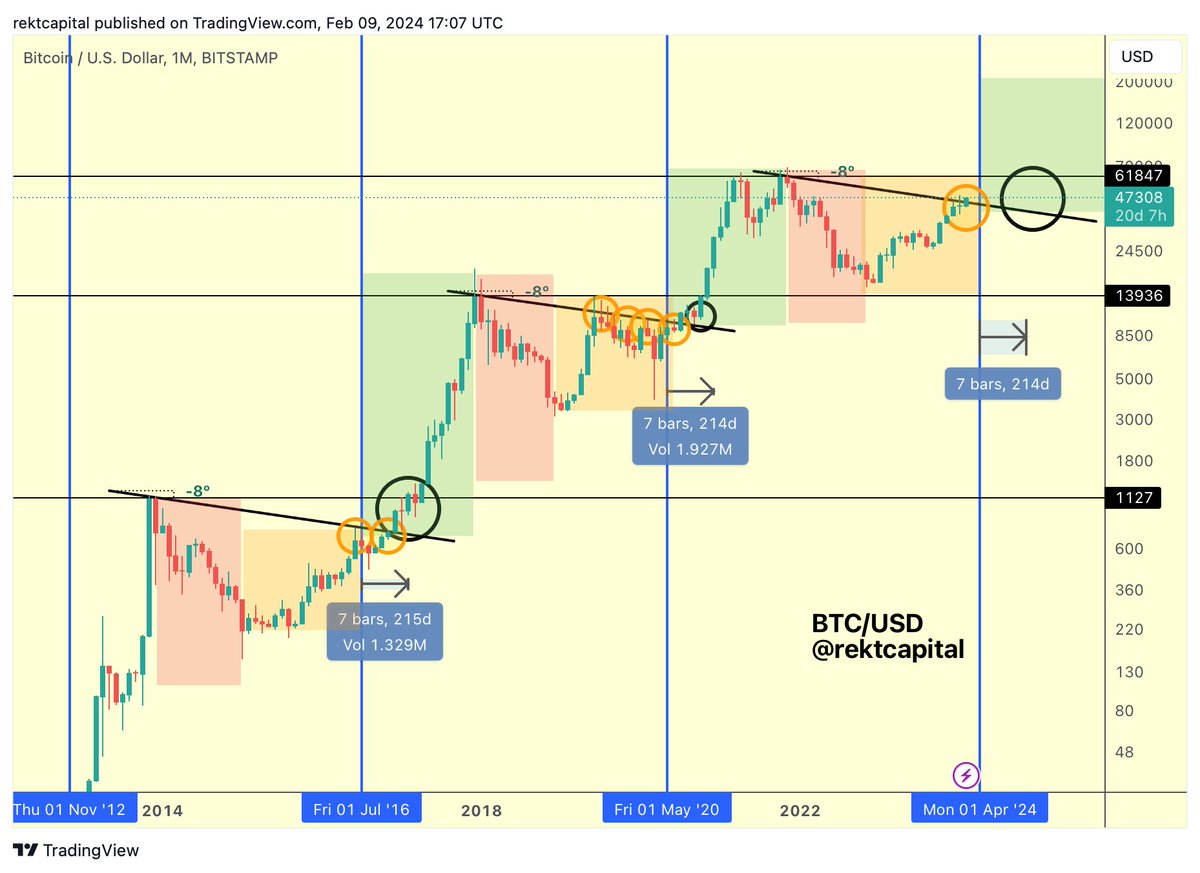

A popular crypto analyst, Rekt Capital, predicts that Bitcoin (BTC) is entering a pre-halving rally phase and may follow a historical pattern over the next two months.

Key Points:

- Bitcoin may experience a temporary rise above $46,000 but stay below it on the monthly chart.

- The halving event, occurring every four years, reduces miners’ rewards by half.

- Bitcoin’s rally phase may end with an upside wick in February, followed by a range formation in March.

- A pre-halving retracement could occur a few weeks before the halving event.

Pre-Halving Rally and Historical Patterns

Rekt Capital highlights the historical tendencies of Bitcoin’s pre-halving rally phase, where it often fails to break beyond a key diagonal resistance trendline and its four-year cycle resistance.

Reconciling Historical Tendencies

To reconcile these tendencies, Rekt Capital suggests that Bitcoin’s pre-halving rally phase may have limited upside, resulting in an upside wick at the end of February, similar to previous years. This could be followed by a range formation in March, allowing altcoins to gain momentum. Finally, a pre-halving retracement could occur a few weeks before the halving event itself.

Current Market Situation

At the time of writing, Bitcoin is trading at $47,387, showing a 2.80% increase in the last 24 hours.

Disclaimer

The opinions expressed in this article are not investment advice. Investors should conduct their due diligence before making any high-risk investments in Bitcoin, cryptocurrency, or digital assets.