A popular crypto analyst, Rekt Capital, has weighed in on where Bitcoin (BTC) might hit bottom in the current market slump. Using technical indicators, Rekt Capital suggests a possible support level.

$70,000 Support Level?

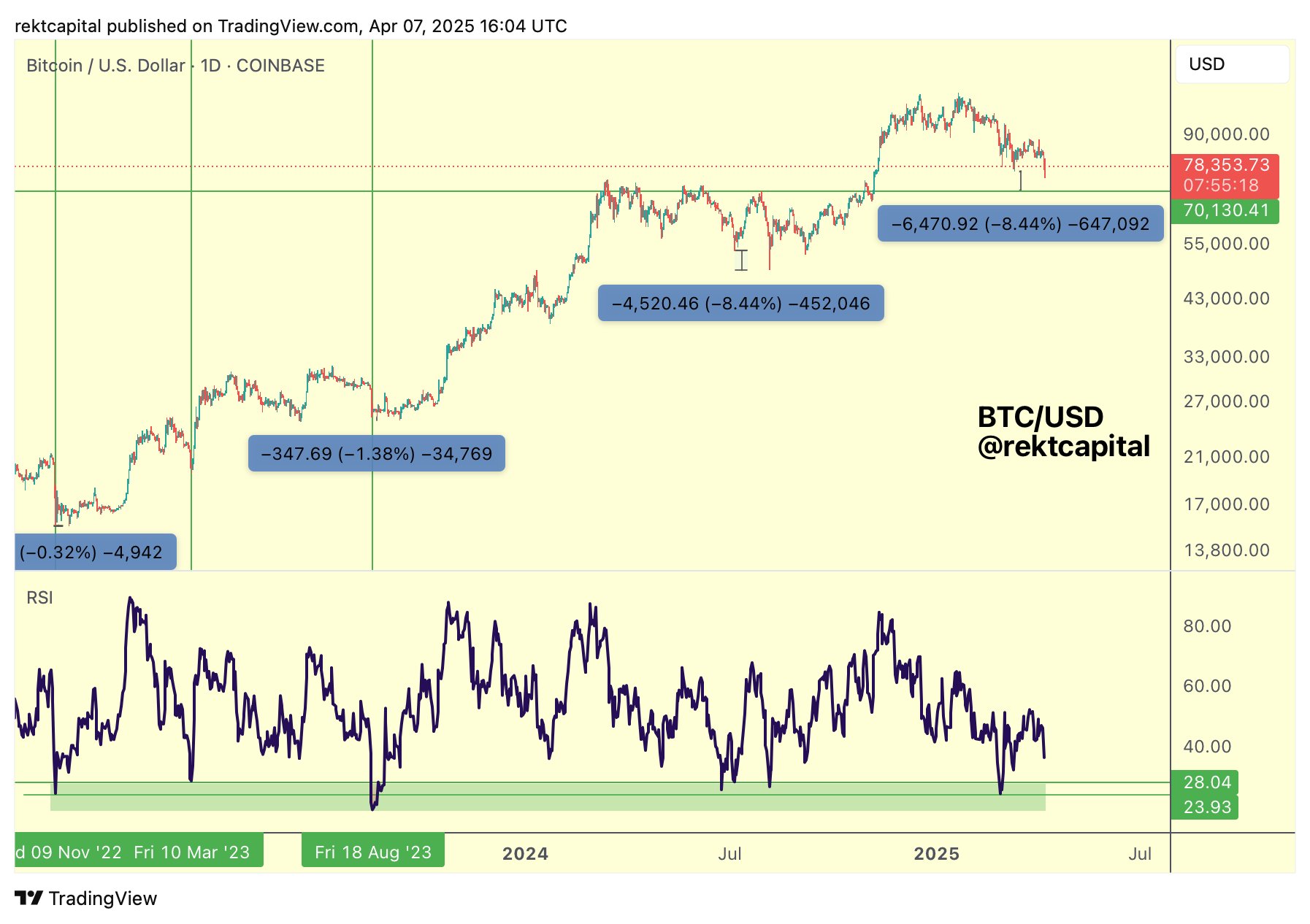

Rekt Capital, who boasts a huge following on X (formerly Twitter), points to the Relative Strength Index (RSI) as a key indicator. Historically, when Bitcoin’s daily RSI dips below 28, the actual price bottom often ends up slightly lower. Based on this, Rekt Capital estimates a potential bottom around $70,000. This prediction accounts for the possibility of Bitcoin falling a bit further than previous lows indicated by the RSI.

Bullish Reversal Clues

According to Rekt Capital, a key sign of a potential Bitcoin price upswing would be a break above, and sustained hold of, the $78,550 resistance level. Currently, Bitcoin hasn’t retested the March lows around this price, suggesting it might act as resistance in the near future. For a bullish trend to take hold, Bitcoin would need to reclaim this level as support.

Volume Gap and Price Action

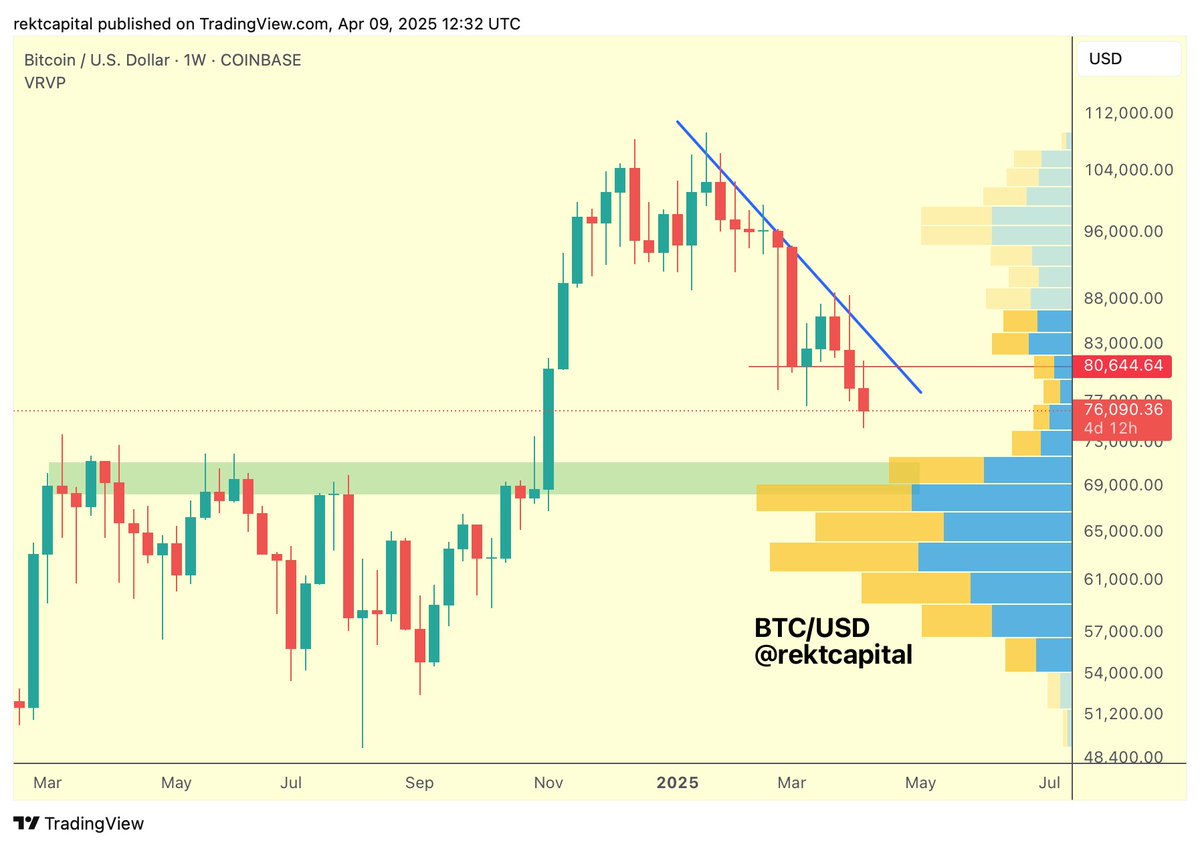

Rekt Capital also highlights a significant volume gap on Bitcoin’s weekly chart, centered around $70,000. This gap represents a period of low trading volume, and market inefficiencies often lead to price movements that fill these gaps. The analyst suggests Bitcoin’s current downward trend might continue until this gap is filled.

Current Market Situation

At the time of writing, Bitcoin is trading around $77,500, slightly down for the day. The analyst’s predictions, however, should be considered alongside your own research and risk tolerance. Remember that the cryptocurrency market is highly volatile, and investing in crypto carries significant risk.