Bitcoin started October with a big slump, disappointing many investors who were expecting a continued price climb. After a strong run in September, Bitcoin took a dive in the first 24 hours of October, falling below $61,000. This drop was fueled by a combination of factors, including tensions in the Middle East and a wave of money flowing out of the crypto market.

Bitcoin’s Rollercoaster Ride

The mood leading into October was pretty bullish, with many predicting Bitcoin would break through key resistance levels. September ended with Bitcoin up 7% from the start of the month, even hitting a high above $66,000. But things took a turn for the worse, and Bitcoin is now down almost 7% from that peak.

This sudden downturn has shaken investor confidence, with the Fear and Greed Index, which measures market sentiment, now showing “Fear.” Crypto analysts are noticing the panic, with some even saying they haven’t seen a green candle (a price increase) in a while.

Geopolitical Tensions and Bitcoin’s Role

Bitcoin’s price is often influenced by global events, and the recent drop can be linked to the conflicts in the Middle East. This raises questions about Bitcoin’s role as a safe haven asset, which is typically associated with gold.

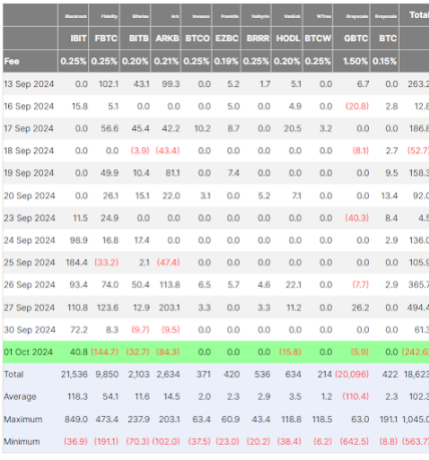

Even institutional investors are pulling back, with Spot Bitcoin ETFs seeing massive outflows on October 1st, likely due to the Middle East tensions. These ETFs are designed to support Bitcoin’s price, so this move is a significant indicator of market sentiment.

Is Uptober a Myth?

While the optimistic outlook has dimmed for some, many investors are still holding onto the belief that October will be a good month for Bitcoin. Historically, October has often been a positive month for Bitcoin, especially in the second half.

It’s still early in the month, so it’s best to wait and see how things play out before declaring “Uptober” a myth. The current tensions could even lead to Bitcoin gaining more traction as a safe haven asset, similar to gold, as the month progresses.