Bitcoin recently took a bit of a dive, dropping significantly due to worries about US trade policies. But it’s bounced back up to around $80,000. Let’s look at what’s happening.

Market Overview: Bitcoin Holds Strong

Despite the price swings, Bitcoin’s market cap remains a hefty $1.5 trillion. While Bitcoin recovered some ground, other cryptocurrencies (altcoins) are still struggling. Interestingly, Bitcoin’s dominance in the crypto market is up to 60%, suggesting investors are flocking to it as a safe haven during this economic uncertainty. Analysts say the market’s reaction is driven by broader economic fears, not just crypto-specific issues.

Futures Market: A Closer Look

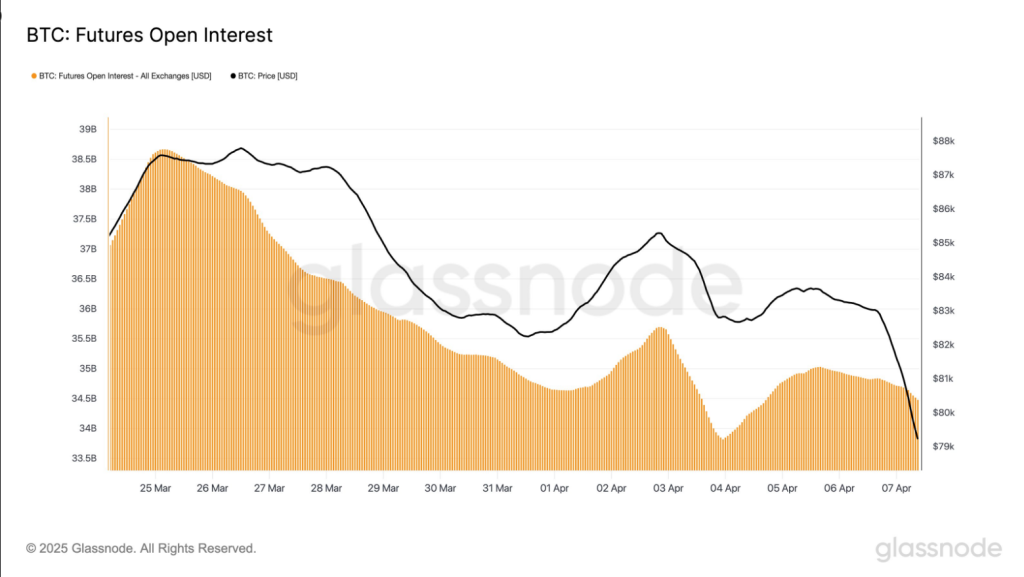

Bitcoin futures open interest (the total value of outstanding futures contracts) dipped to $34.5 billion, recovering slightly from a low of $33.8 billion on April 3rd. However, the overall trend is still downward. Traders are reducing their risk by cutting back on futures exposure as Bitcoin’s price momentum slows. This reduction is evident in both cash-margined and crypto-margined open interest. However, there are signs that some traders are starting to take on riskier positions again, as crypto-margined open interest is ticking back up. This could mean increased volatility soon.

Liquidations: A Surprisingly Calm Market

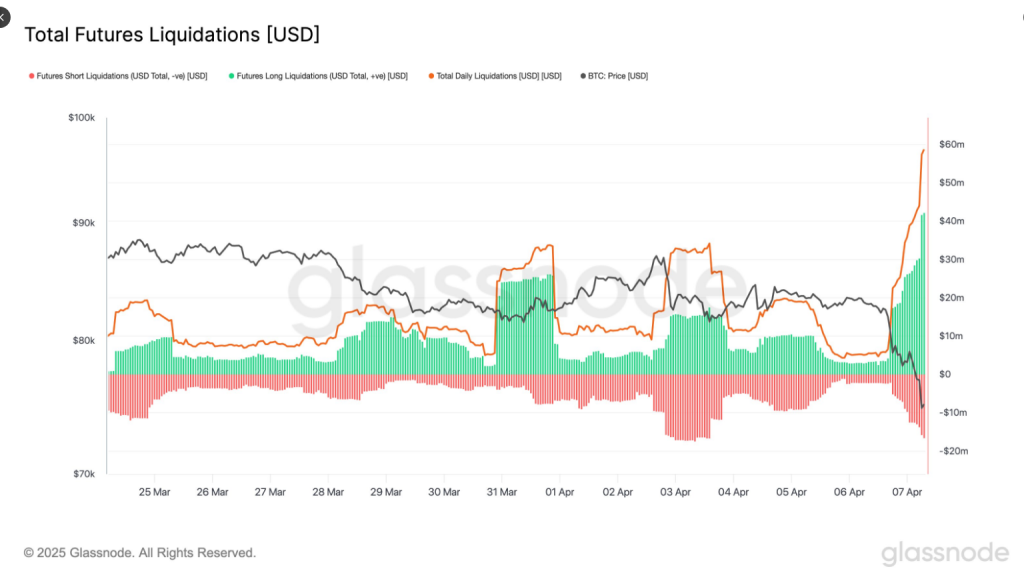

Over the past 24 hours, only about $58 million worth of Bitcoin futures contracts were liquidated. This is surprisingly low considering Bitcoin’s 10% price drop. Longs (those betting on price increases) took the biggest hit, but the overall low liquidation numbers suggest the market wasn’t heavily leveraged before the selloff. This contrasts sharply with previous events where daily liquidations exceeded $140 million. The current price drop seems to be driven by regular selling, not forced liquidations due to excessive leverage.

Institutional Interest Remains High

Despite the volatility, institutional investors are still showing interest in Bitcoin. Over the past two months, 76 new institutions holding over 1,000 BTC each have joined the network – a 4.5% increase in large Bitcoin holders.