Bitcoin’s recent price drop has sparked concerns, but some analysts see reasons for optimism. Let’s dive into their predictions and analysis.

Massive Liquidation Potential Points to a Bitcoin Price Rebound

Crypto analyst Kevin Capital points to a significant disparity in Bitcoin liquidation data as a potential indicator of a price recovery. He highlights that while there’s only $1.5 billion in long liquidations (selling pressure) between the current price and $77,000, a whopping $16 billion in short liquidations (buying pressure) exists between the current price and $107,000. This huge difference, he says, is historically unusual.

Kevin argues that market makers, who aim to maximize profits, will likely target this massive pool of short liquidations, leading to a price increase. While he advises patience (especially considering a 3-day chart pattern), he suggests the outlook is becoming more bullish.

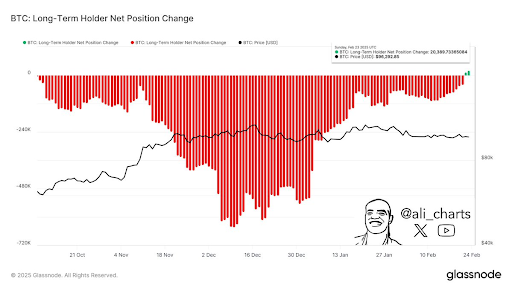

Long-Term Holders Remain Confident

Despite the recent price crash to as low as $86,000, some long-term Bitcoin holders are doubling down. Analyst Ali Martinez reported accumulating nearly 20,400 BTC after the recent sell-off, showcasing continued confidence in Bitcoin’s future price growth.

A Potential Dip Before the Next Rally?

However, not everyone is as optimistic. Analysts Ali Martinez and Titan of Crypto suggest Bitcoin could see further price drops.

Martinez draws parallels to the 2021 market top, suggesting a period of consolidation at current levels might precede another price decline, potentially pushing Bitcoin down to around $80,850.

Titan of Crypto echoes this sentiment, citing a broken trendline and the possibility of Bitcoin falling to the $81,000 support level.

Current Market Conditions

At the time of writing, Bitcoin is trading around $88,700, down over 3% in the last 24 hours. The conflicting predictions highlight the volatility of the crypto market and the challenges of accurately forecasting Bitcoin’s price.