The US Dollar Index (DXY) recently took a major dive – one of its biggest three-day drops in history! This has some experts predicting a huge Bitcoin price surge.

The Dollar’s Fall and Bitcoin’s Rise: A Historical Look

Jamie Coutts, a crypto analyst, looked at past instances where the DXY dropped sharply. His analysis suggests a strong correlation between these drops and significant Bitcoin price increases.

He ran two tests:

Test 1: DXY drops over 2.5% in 3 days:

- Eight times since 2013, the DXY fell more than 2.5% over three days.

- Every single time, Bitcoin’s price went up within the following 90 days!

- Average increase: 37% (around $123,000 BTC)

- Even the worst-case scenario showed a 14% gain (around $102,000 BTC).

Test 2: DXY drops over 2% in 3 days:

- Eighteen times since 2013, the DXY fell more than 2% over three days.

- Bitcoin’s price went up 17 out of 18 times (94% win rate).

- Average increase: 31.6% (around $118,000 BTC)

- The worst outcome still resulted in only a 14.6% decrease (around $76,500 BTC).

What Does This Mean for Bitcoin?

While these tests aren’t a crystal ball, they suggest a positive outlook. A weaker dollar often means investors are looking for alternative investments, and Bitcoin often benefits from this shift. Coutts even boldly predicted new Bitcoin highs by May.

He points out that this significant DXY drop happened despite recent regulatory concerns and a tough February for Bitcoin. He sees this as a sign that the market is poised for a major rebound, mirroring similar historical patterns. He also highlighted other indicators suggesting a market bottom has been reached and a new bull run is on the horizon.

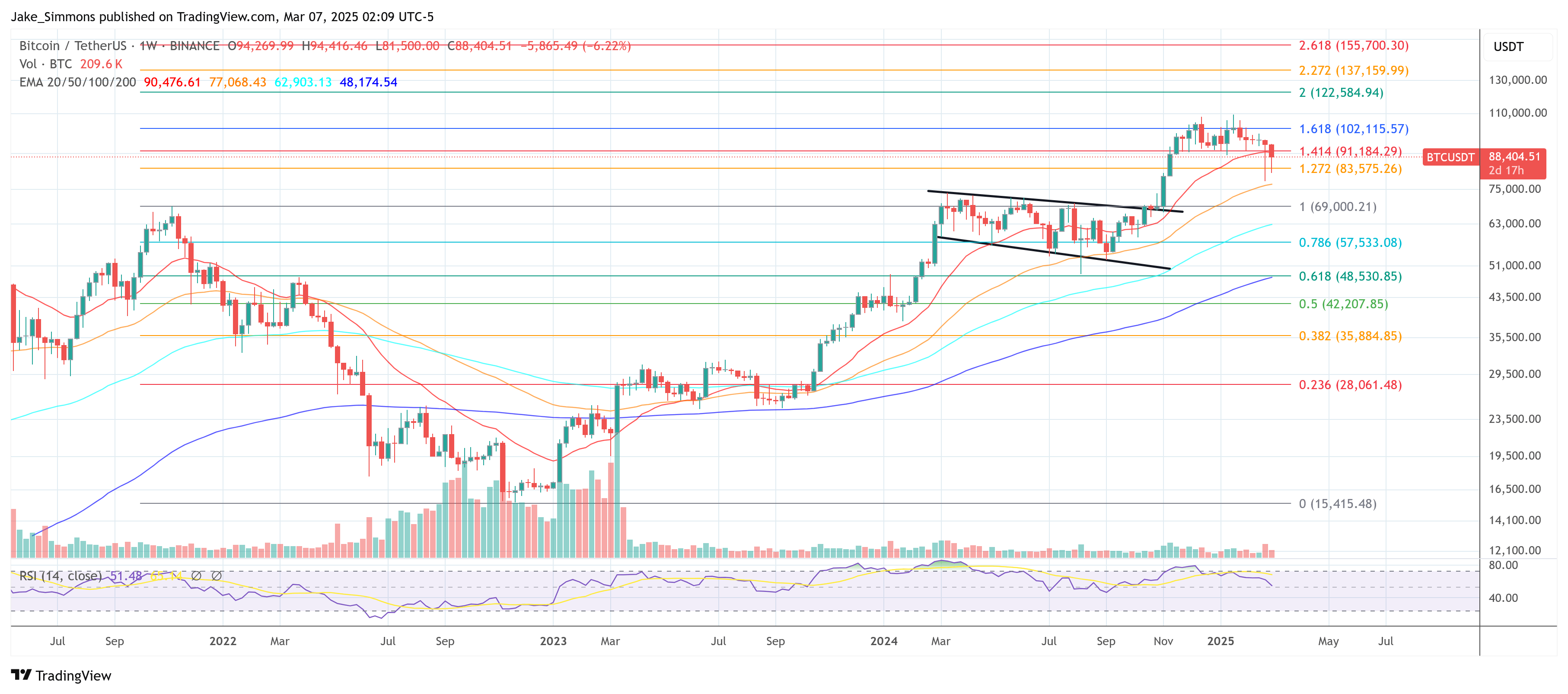

At the time of writing, Bitcoin was trading at $88,404.