Bitcoin has been holding steady above $100,000 recently, but its price action has been a bit sluggish. While some see this as a sign of weakness, a closer look at the options market suggests otherwise.

Options Market Shows Bullish Sentiment

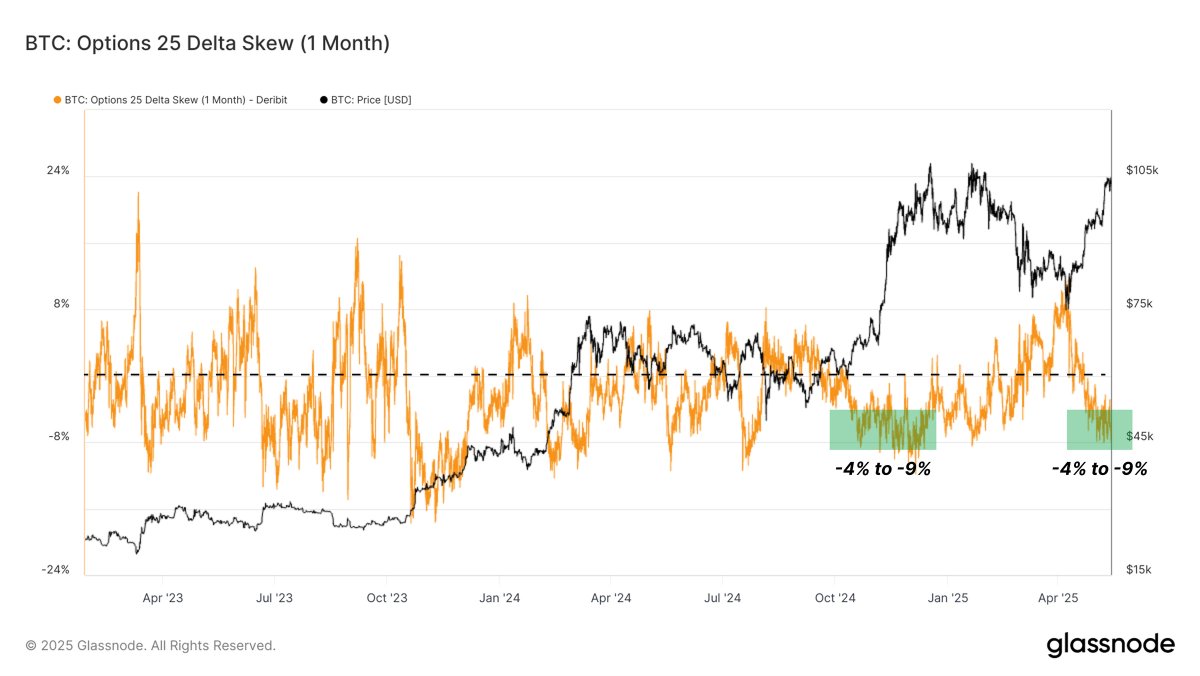

Recent analysis from Glassnode reveals a shift in trader sentiment. Their key indicator, the 1-month 25 Delta Skew, shows a significant change. This indicator compares the implied volatility of bullish bets (call options) to bearish bets (put options).

A negative value means call options (bets on Bitcoin going up) are more expensive than put options (bets on Bitcoin going down). Glassnode reported a recent drop to -6.1%, indicating that traders are increasingly optimistic about Bitcoin’s future price. This is a “risk-on” environment, where investors are more willing to take chances.

Historically, a negative 25 Delta Skew has been a strong predictor of Bitcoin price increases. This bullish sentiment, combined with more investors taking long positions, could fuel further growth.

Bitcoin Price Update

At the time of writing, Bitcoin is trading around $102,800, down slightly over the past 24 hours. However, the positive signals from the options market suggest this dip might be temporary. The overall picture painted by the options market data points towards a potential for further price appreciation.