Bitcoin recently dipped a bit, causing some to wonder if the party’s over. But one analyst, Titan of Crypto, thinks the bull market still has some steam left.

A Repeating Pattern?

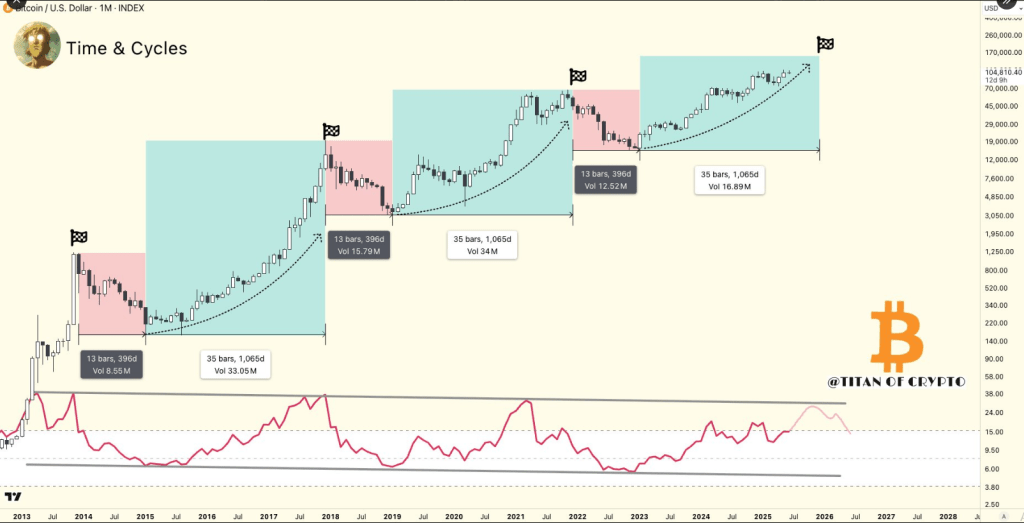

Titan noticed a fascinating pattern in Bitcoin’s previous cycles. Each one started with a roughly year-long (13 months) steep decline, followed by a much longer period (around 3 years or 35 months) of significant gains. This pattern seems to have repeated itself, suggesting the current rally might have further to run.

What About the RSI?

Some analysts are worried because the Relative Strength Index (RSI) is weakening. A lower RSI often signals a price correction. However, Titan’s analysis focuses on the time-based pattern, while other indicators like RSI, trading volume, and on-chain data provide a real-time picture of market demand.

How High Can It Go?

Based on the historical pattern, we might see at least five more months of upward movement before the peak. Some predictions even suggest Bitcoin could hit $137,000 before a major pullback. Even more bullish predictions from prominent figures like Samson Mow (Jan3 CEO), Raoul Pal (Real Vision), and Michael Saylor point to Bitcoin potentially reaching $1 million or more before a significant correction. They cite factors like government adoption, increasing institutional investment, and the upcoming halving (which reduces Bitcoin’s supply) as reasons for this potential surge.

The Bigger Picture

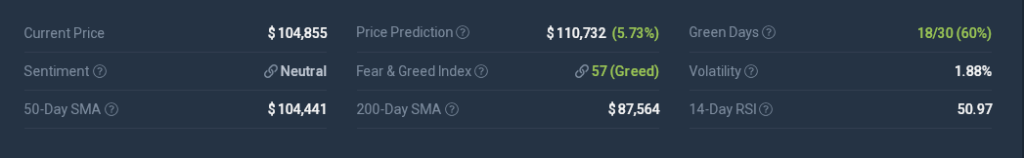

This isn’t just a repeat of past cycles. Bitcoin’s current trajectory is influenced by ETFs, large corporate investments, and a more sophisticated understanding of on-chain data. Current short-term predictions point towards continued growth, with some suggesting a price around $110,732 by mid-July. While the overall market sentiment is currently positive, it’s important to remember that the crypto market is inherently volatile.