Bitcoin has been relatively stable lately, despite some market uncertainty. While it hasn’t skyrocketed recently, some analysts believe a significant price increase is still possible.

Is Bitcoin Ready to Climb Higher?

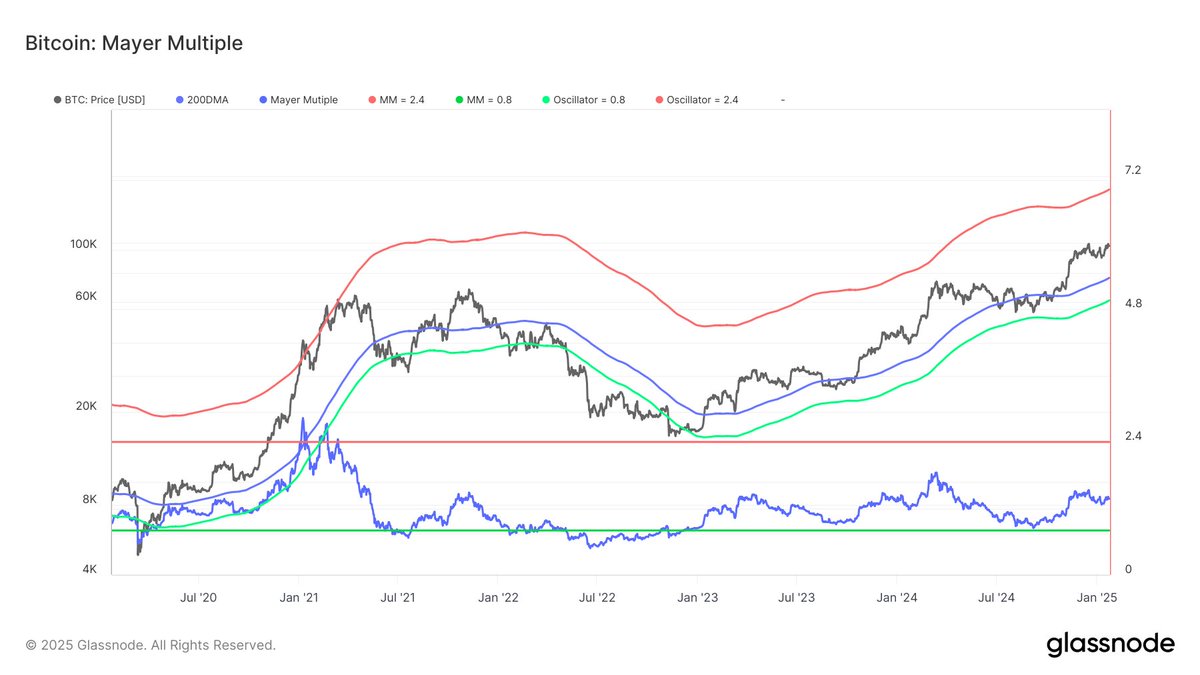

Data analysis firm Glassnode recently suggested Bitcoin isn’t overheated and could climb further. They used the Mayer Multiple indicator, which compares Bitcoin’s price to its 200-day moving average. This helps determine if the price is too high (overbought) or too low (oversold).

A Mayer Multiple above 2.4 usually signals an overbought market, potentially indicating a price peak. Conversely, a value below 0.8 suggests an oversold market and a potential bottom.

Currently, Bitcoin’s Mayer Multiple is 1.37, far from the overbought zone. This suggests there’s still room for growth. The fact that Bitcoin’s price is over 35% above its 200-day moving average also points to a bullish outlook.

The $180,000 Prediction

Glassnode estimates Bitcoin would need to hit $180,000 to become overbought. This figure represents a potential peak for this cycle, after which a price correction might occur. Conversely, the oversold threshold suggests a potential bottom around $60,000.

Bitcoin’s price hasn’t seen dramatic gains since crossing $100,000, leading some to believe the peak is already behind us. However, the Mayer Multiple offers a different perspective, suggesting further potential upside.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading slightly below $105,000, showing little change in the last 24 hours.