Bitcoin’s been stuck below $100,000 since early February. The excitement around Trump’s administration and crypto has cooled off, slowing the bull run. But don’t count Bitcoin out just yet!

Bitcoin’s Quiet Accumulation

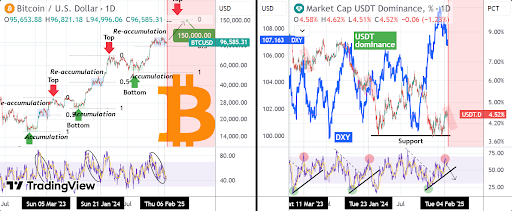

Technical analysts see this lull as a buying opportunity—a “re-accumulation phase.” This is a pattern seen before major price jumps. Interestingly, the dominance of Tether (USDT) seems to play a key role in these rallies.

The USDT Factor

USDT dominance refers to how much of the total crypto market is held in USDT (a stablecoin). High USDT dominance means people are holding onto stablecoins instead of riskier crypto investments. A drop in USDT dominance often signals a shift back into crypto, including Bitcoin.

This pattern has repeated itself: Bitcoin saw two major re-accumulation periods (Jan-Mar 2023 and Nov 2023-Feb 2024) that both coincided with falling USDT dominance. Both periods also saw a dip in the Dollar Index (DXY). And guess what? We’re seeing a similar pattern now, starting in December 2024.

The $150,000 Prediction

If history repeats itself, this re-accumulation phase could end soon, leading to a massive Bitcoin rally. One analyst predicts a price surge to $150,000—a 54% increase from the current price (around $97,175). However, Bitcoin needs to break through the $100,000 resistance level first. This is a significant psychological barrier.

The Bottom Line

While nothing is guaranteed in the crypto world, the confluence of factors—re-accumulation phase, falling USDT dominance, and historical patterns—suggests a potential for a significant Bitcoin price increase. But remember, this is speculation, and the market can be unpredictable.