Bitcoin is on the rise again, potentially breaking through $69,000. This could be the start of a big rally in the coming months. But what’s the long-term picture?

The Stock-to-Flow Model: A Bitcoin Price Predictor?

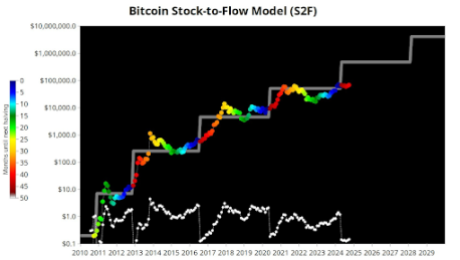

A model called “Stock-to-Flow” (S2F) is suggesting that Bitcoin is ready for a major price jump. This model, which was originally used for precious metals like gold, looks at how much of a resource is already available (stock) compared to how much is being added (flow).

For Bitcoin, the S2F model takes into account its limited supply (only 21 million coins will ever exist) and the halving events that happen every four years. These halvings cut the amount of new Bitcoin being created in half, making it more scarce.

Past Halvings, Future Price Jumps?

The S2F model suggests that past halvings have been followed by significant price increases for Bitcoin. For example, the 2020 halving led to Bitcoin reaching a new all-time high of around $66,000.

Since the last halving in April 2024, the effects of reduced supply are starting to be felt. This could push Bitcoin towards a new price level above $100,000.

What Does This Mean for Bitcoin?

If the S2F model is right, a price jump above $100,000 would act as a floor, supporting further price increases. This could lead to Bitcoin reaching a peak of nearly $1 million before the next halving in 2028.

Of course, this is just a prediction based on past trends. It’s impossible to say for sure what will happen to Bitcoin’s price. But the S2F model is definitely something to keep in mind as Bitcoin continues its journey.