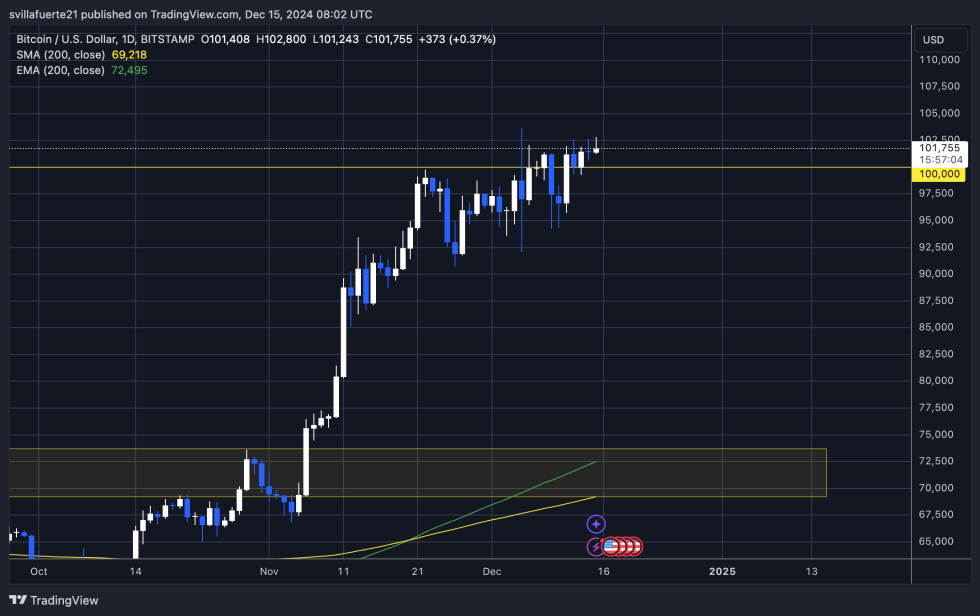

Bitcoin has been chilling above $100,000 after hitting a new high, but the crypto world is buzzing with what’s next.

Institutional Investors Are Watching

Analyst Maartunn from CryptoQuant noticed something interesting: CME Bitcoin options open interest is spiking. This means big institutional players are making some serious bets. Historically, this kind of activity has led to big price swings for Bitcoin. So, while things are calm now, that might not last.

The Calm Before the Storm?

Bitcoin’s been climbing steadily since late November, but it hasn’t had a massive breakout yet. It’s been inching upwards, but everyone’s waiting for the next big move.

Put Options Are Stacking Up

Maartunn also pointed out a huge increase in “put” options. These are bets that the price will go down . A lot of these options suggest a potential price drop is brewing. High leverage in these positions means a correction could be messy if Bitcoin doesn’t break through its all-time high.

. A lot of these options suggest a potential price drop is brewing. High leverage in these positions means a correction could be messy if Bitcoin doesn’t break through its all-time high.

Will Bitcoin Break Through Resistance?

Bitcoin is currently hovering around $101,750, struggling to break past $102,000.

- Bullish Scenario: If Bitcoin can power past $103,600, it could signal a continued upward trend and new highs.

- Bearish Scenario: Failure to break $103,600 could mean a retest of lower support levels around $95,500. This would likely trigger more selling and a bigger correction.

The next few days will be crucial. A decisive move, either up or down, will set the tone for the whole crypto market.