Bitcoin’s recent price action suggests a potential surge towards a crucial price range.

Breaking Out of the Wedge

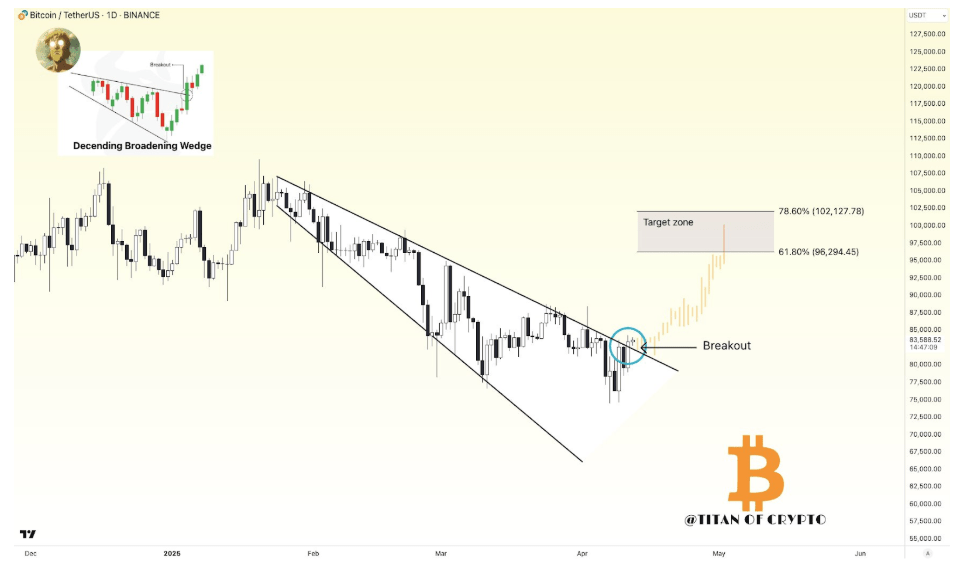

Bitcoin just broke through a significant chart pattern called a “descending broadening wedge.” This often signals a price reversal and suggests a strong upward trend is likely. One crypto analyst, Titan of Crypto, pointed this out on X (formerly Twitter). The wedge formed over the last three months, starting after Bitcoin hit its peak above $108,000 in late January. The breakout, confirmed by two daily closes above the wedge’s upper trendline, could pave the way for a serious price increase.

The $100,000 Target Zone

Titan of Crypto predicts Bitcoin could easily hit $96,200, potentially even surpassing $100,000 again. However, the zone between $96,200 and $102,100 will be a major test. This will show whether the upward momentum continues or if Bitcoin faces resistance.

A Short Squeeze on the Horizon?

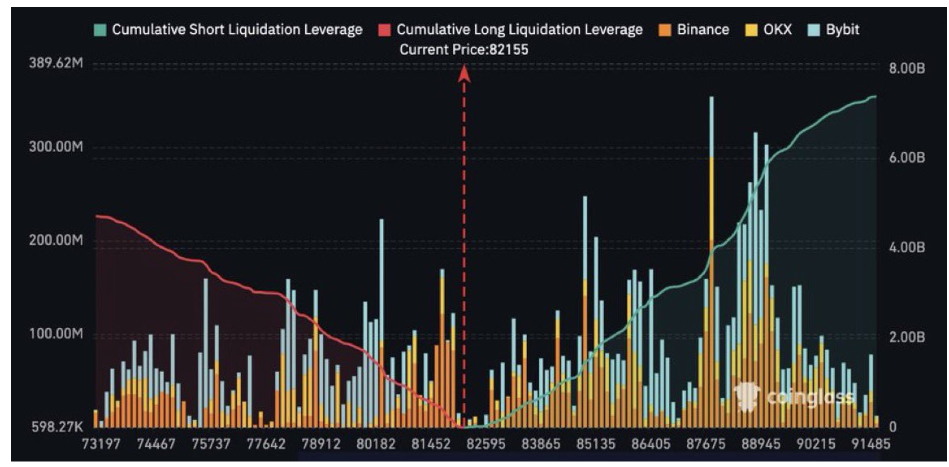

Another analyst, Sensei, highlights a potential “short squeeze.” Data from Coinglass shows over $8 billion in short positions (bets that Bitcoin will go down) could be liquidated if Bitcoin climbs above $90,000. This massive wave of forced buying could fuel the price even higher, potentially pushing it towards that $96,200 – $102,100 target zone. This short selling is concentrated on major exchanges like Binance, OKX, and Bybit.

What’s Next?

Bitcoin was trading around $84,706 at the time of writing. The coming days will be crucial in confirming the breakout and determining whether Bitcoin can truly reach the predicted price range. The potential short squeeze adds another layer of excitement to the situation.