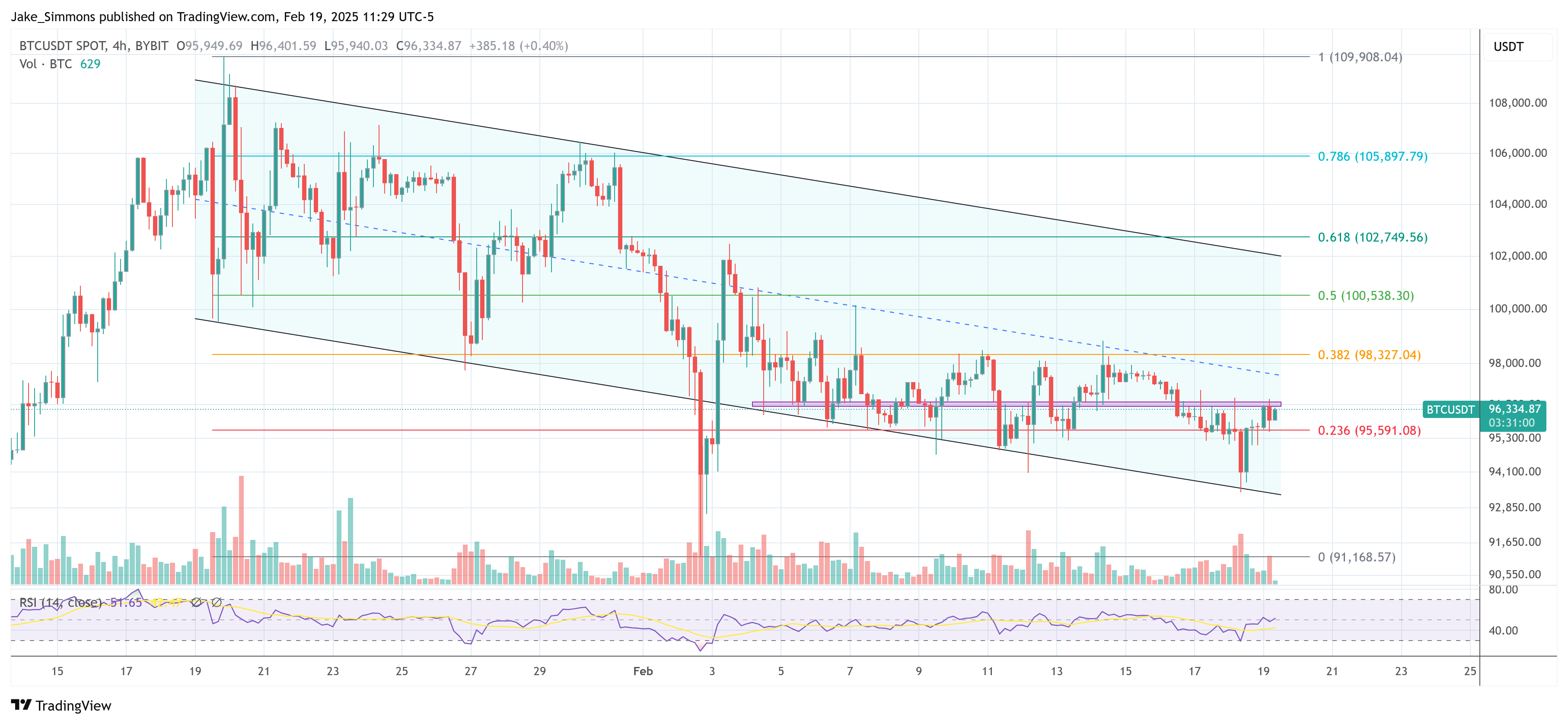

Bitcoin’s price is stuck below $96,500, but a closer look at the trading data suggests a potential price surge is brewing.

A Liquidity Bonanza

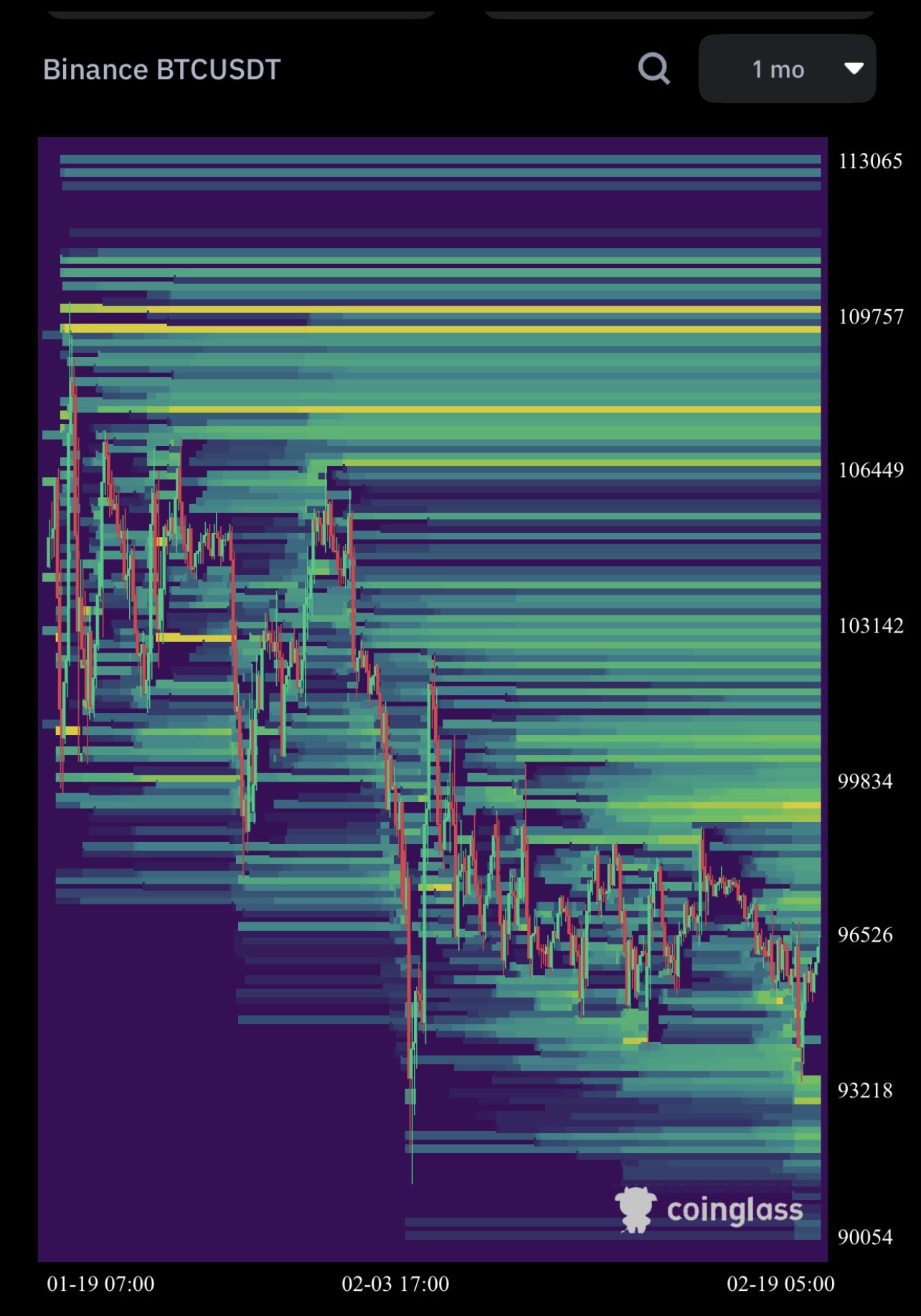

Analyst Kevin (@Kev_Capital_TA) has analyzed Binance’s BTC/USDT trading data and spotted something interesting: massive amounts of liquidity clustered around specific price points. He’s not just talking about a little extra cash; we’re talking billions of dollars worth of leveraged positions waiting to be liquidated.

There are two key areas:

- Around $91,000: This area might see some price action, but it’s not the main event.

- Around $111,000: This is where the real action is. Kevin says he’s never seen this much liquidity stacked up at this level on a monthly chart. This massive amount of potential liquidations suggests a strong possibility of a significant price increase.

Why $111,000?

These liquidity clusters are important because they represent points where a lot of traders have placed stop-loss orders or are heavily leveraged. If the price hits these levels, a wave of forced liquidations could send the price soaring even higher – a short squeeze. Kevin believes the huge amount of liquidity at $111,000 is a key indicator of a potential rally to that level.

The Emotional Rollercoaster and What to Watch

Kevin points out that many traders are too focused on altcoins and ignoring the bigger picture: Bitcoin’s overall market health, its market cap, and USDT dominance. He thinks this narrow focus is causing them to miss crucial signals.

He also notes the current market sentiment is extremely fearful (as indicated by the Fear & Greed Index). This fear, combined with the massive liquidity waiting to be unleashed, could be the perfect setup for a rapid price increase. He advises traders to stay calm and avoid getting caught up in the negativity.

The Bottom Line

While Bitcoin is currently trading below $97,000, the massive amount of liquidity at $111,000 on Binance suggests a potential for a significant price increase. Kevin’s analysis highlights the importance of looking beyond individual altcoins and focusing on broader market indicators. Whether or not his prediction comes true remains to be seen, but the data certainly suggests the possibility of a dramatic price swing.