Bitcoin’s price has been a rollercoaster lately. After dipping below $75,000, it bounced back to over $83,000. But analysts at CryptoQuant see potential roadblocks ahead.

Major Resistance Zones Identified

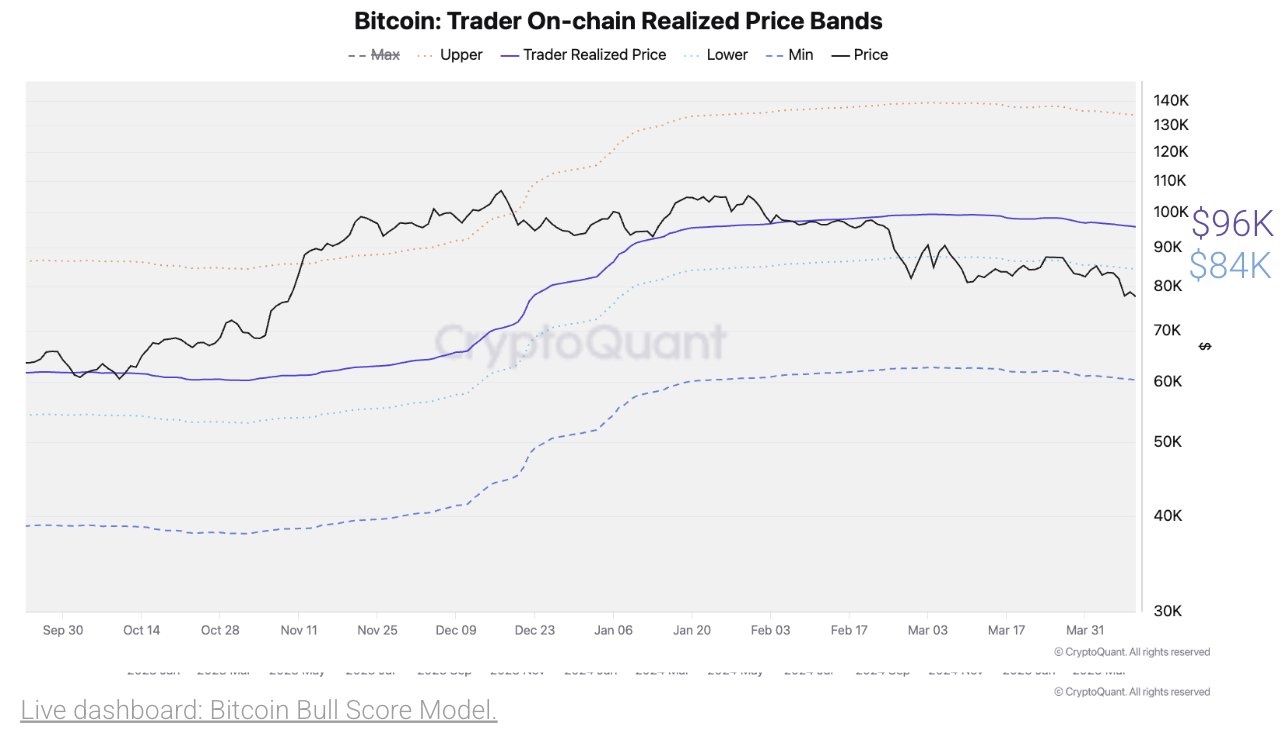

CryptoQuant, using their “Realized Price” metric, pinpointed two significant resistance levels for Bitcoin: $84,000 and $96,000. The Realized Price reflects the average price at which Bitcoins last changed hands. When Bitcoin trades above this price, it generally means most holders are in profit – a bullish sign. Below it, and many are losing money. These levels have acted as support in the past, but now they might act as resistance.

What the Realized Price Means

Think of the Realized Price as a kind of market sentiment indicator. It often acts as strong support during bull markets and strong resistance during bear markets. Currently, CryptoQuant’s Julio Moreno puts the Realized Price at $96,000, with a lower band around $84,000.

Breaking Through the Barriers

If Bitcoin can power past $84,000 and $96,000, it could signal a return to a bull market, potentially pushing Bitcoin as high as $130,000 (a 55% jump from current prices).

Current Market Conditions

At the time of writing, Bitcoin is trading around $83,180, up slightly for the day. Trading volume is down, however. The overall market is a bit uncertain due to things like US government tariff changes. However, there’s some good news: Glassnode shows strong support around $79,000 and $82,080, where a significant number of Bitcoin have been accumulated. These levels could act as short-term support if the price drops.

Bitcoin Remains Dominant

Despite the uncertainty, Bitcoin remains the biggest cryptocurrency by a wide margin, holding over 60% of the total crypto market cap, with a market cap of $1.66 trillion.