A crypto analyst is predicting a significant Bitcoin price drop, forecasting a crash to $40,000. Let’s dive into the details.

Halving Cycles and Market Predictions

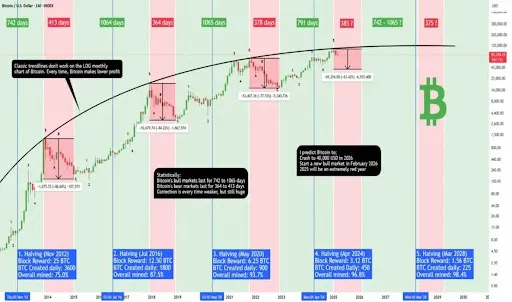

The prediction is based on Bitcoin’s historical price cycles, tied to its “halving” events (which happen every four years). These events seem to alternate between bull markets (prices soar) and bear markets (prices plummet). Historically, bull markets have lasted around 2-3 years, while bear markets last about a year.

However, each bull market has been weaker than the last, due to Bitcoin’s increasing market cap. Past crashes have seen Bitcoin’s price fall by 77% to 86%. This analyst, Xanrox, predicts a 65% drop to $40,000, considering Bitcoin’s larger market cap and growing institutional investment. They support this prediction with charts showing historical halving cycles.

Why a $40,000 Price?

With Bitcoin’s current market cap of around $1.63 trillion, reaching extremely high price targets like $300,000 or more seems unrealistic, according to the analyst. They suggest 2025 might be a bearish year, with the next bull run starting in 2026.

Other Bearish Signals

Adding to the bearish outlook, CryptoQuant’s CEO, Ki Young Ju, also believes the Bitcoin bull cycle is over. He expects choppy price action for the next 6-12 months, typical of a bear market. He points to various on-chain metrics confirming this bear market prediction, including whales selling at lower prices. Bitcoin’s current price is already down over 20% from its all-time high.