Cathie Wood, CEO of Ark Invest, is sticking to her prediction: Bitcoin could hit $1.5 million by 2030. This audacious forecast has definitely gotten people talking in the crypto world. She revealed this at Ark’s Big Ideas 2025 conference, even suggesting the chances of it happening have increased.

The Path to a Million-Dollar Bitcoin

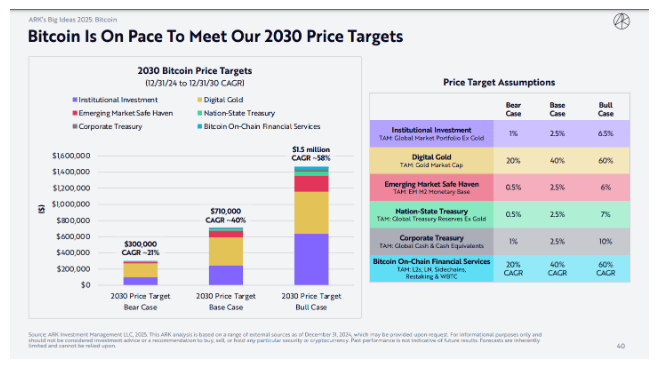

This isn’t just a wild guess. Ark Invest has laid out three scenarios:

- Conservative: $300,000

- Middle Ground: $710,000

- Bullish: $1.5 Million

These scenarios represent annual growth rates of 40%, 21%, and 58%, respectively, from Bitcoin’s current value.

Institutional Money Flooding the Crypto Market

Ark’s research shows a big shift in Bitcoin investment. Their most optimistic scenario suggests institutional investors could allocate up to 6.5% of their global portfolios to Bitcoin. Major financial firms are already using Bitcoin for diversification, seeing its unique risk-reward profile. The possibility of Bitcoin capturing up to 60% of gold’s market cap adds further weight to this prediction. Wood herself has stated on CNBC that a base case scenario sees Bitcoin reaching $600,000 by 2030, with the potential for $1.5 million in a bull market.

Stablecoins: Outpacing Payment Giants

Ark’s research also highlights the explosive growth of stablecoins. In 2024, stablecoin transaction values hit a staggering $15.6 trillion – surpassing both Mastercard and Visa! While traditional payment systems still handle more individual transactions, the sheer volume of money flowing through stablecoins paints a clear picture of the future of digital finance.

Multiple Factors Fueling Bitcoin’s Growth

Wood’s positive outlook isn’t based on a single factor. Ark sees a combination of drivers, including:

- Bitcoin adoption as a safe haven in emerging economies.

- Governments adding Bitcoin to their treasury reserves.

- Corporations using on-chain finance to diversify cash.

Essentially, Bitcoin’s growing use in various sectors could easily drive its price up. As cryptocurrencies gain popularity as a digital gold alternative and their share of institutional portfolios grows, the market might be underestimating their long-term potential. With the ongoing digital revolution in traditional finance, Wood’s ambitious goals might not be so far-fetched after all.