Bitcoin’s open interest recently plummeted to its lowest point in six months. What does this mean for the price of Bitcoin? Several analysts weigh in, offering a surprisingly positive outlook.

A Six-Month Low and What it Means

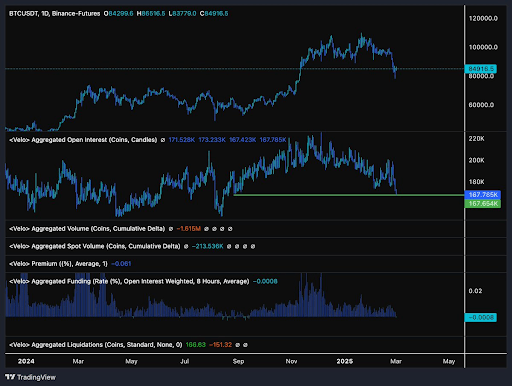

Crypto analyst CrediBULL Crypto noticed Bitcoin’s open interest hitting a six-month low. Interestingly, the last time this happened, Bitcoin was trading between $50,000 and $60,000, before a significant price rally. He also pointed out that Bitcoin’s funding rate just turned negative – a similar situation to the one before Bitcoin’s surge to $100,000. CrediBULL sees these factors as incredibly positive signs, suggesting Bitcoin has hit bottom.

Other Analysts Agree: Bitcoin Bottoms Out?

Analyst Ali Martinez supports this bullish view. He noted that Bitcoin’s Relative Strength Index (RSI) dropped below 30, a historical indicator of a price rebound. With the RSI at 24, he believes Bitcoin has indeed bottomed out.

Holding Above Key Resistance is Crucial

While Bitcoin has rebounded to almost $95,000 after dipping below $80,000, CrediBULL Crypto cautions against premature celebrations. He emphasizes that a sustained move above the key resistance level of around $93,000 is crucial to confirm the reversal. Getting there is one thing, but breaking through that resistance shows real strength.

Titan of Crypto agrees, stating that Bitcoin needs to stay above $94,000 (breaking above the Kumo cloud on the chart) to solidify the reversal. However, he also predicts a potential price surge to over $126,000 if this happens, entering a new “markup phase.”

Global Liquidity and a Buying Opportunity?

Martinez adds another perspective, highlighting the aSORP indicator, which suggests the Bitcoin bull run is still alive. He also points out that global liquidity is increasing, and since Bitcoin is lagging behind, this could represent a unique buying opportunity.

Current Bitcoin Price and Outlook

At the time of writing, Bitcoin is trading around $91,000, a more than 6% increase in the last 24 hours. While caution is advised, the overall sentiment among these analysts leans bullish, suggesting a potential significant price increase is on the horizon if Bitcoin can maintain its momentum above key resistance levels.