Bitcoin is looking incredibly strong right now, according to a recent report. Here’s why:

Long-Term Holders Are Dominating

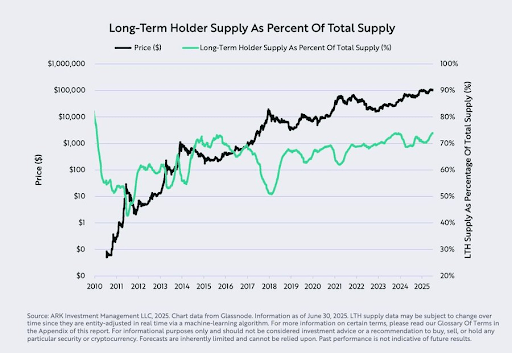

A whopping 74% of all Bitcoin is held by long-term investors – those who’ve held onto their BTC for at least 155 days. This is a 15-year high! This shows serious confidence in Bitcoin as a long-term investment, almost like digital gold. Big institutional investors, like those using ETFs and treasury companies, are driving this trend. They’re known for holding onto their investments for the long haul, even more so than your average investor.

Institutional Investors Are Going All In

This massive institutional buying is a huge factor. It’s pushed Bitcoin’s price to record highs this year, even reaching $123,000 at one point. And the buying hasn’t stopped! Companies like BlackRock and those following strategies like Michael Saylor’s are still accumulating Bitcoin at an incredible rate. The price is still climbing as more investors jump in.

Price Predictions Are Sky High

Cathie Wood of Ark Invest is extremely bullish on Bitcoin, predicting a price of $1.5 million by 2030. She believes Bitcoin will either take market share from gold or significantly expand the overall store-of-value market. Even with the current massive institutional investment, she thinks we’re still in the early stages of adoption.

Other Positive Signs

It’s not just long-term holders; other metrics are also pointing upwards. Global liquidity per Bitcoin is at a 12-year high, meaning there’s a lot of money chasing a relatively limited supply. Plus, Bitcoin recently held strong above key support levels, further strengthening its position.

The Bottom Line

With long-term holders accumulating, institutional investors piling in, and positive price predictions, the future looks bright for Bitcoin. While the current price is around $19,100, the overall trend is undeniably bullish. Only about 1 million Bitcoins remain to be mined, making the existing supply even more valuable.