A crypto analyst, Tony “The Bull” Severino, says a technical indicator suggests Bitcoin could take a while to hit a new price high. Let’s break it down.

The TD9 Setup: A Long-Term Prediction

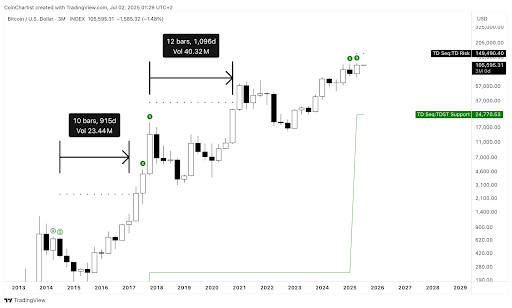

Severino points to a “perfected TD9 sell setup” on Bitcoin’s quarterly chart. This indicator often signals potential trend changes or reversals. In this case, the TD9 suggests a potential price target of around $149,490.

However, the catch is the timeline. Based on past TD9 signals, reaching this target could take years.

Historical Precedents: A Slow Climb

Looking back:

- 2017: A similar TD9 setup predicted a Bitcoin price of $35,000. It took about four years to actually reach that level.

- 2014:

Another TD9 pointed to a $2,400 target. That took roughly 3.5 years to achieve.

Another TD9 pointed to a $2,400 target. That took roughly 3.5 years to achieve.

Following this pattern, the current $149,490 target might not be hit until around July 2029.

Current Bitcoin Price Action: A Steady, Gradual Rise

Despite the long-term prediction, Bitcoin has seen a slow but steady rise over the past week, climbing about 1.5%. While there’s some bullish momentum, it’s still a significant distance from the projected $149,490.

The Bottom Line: Patience (and Time)

While the current market shows some positive signs, Severino’s analysis using the TD9 indicator paints a picture of a long, slow climb to $149,490 for Bitcoin. If history repeats itself, it could be a four-year wait.