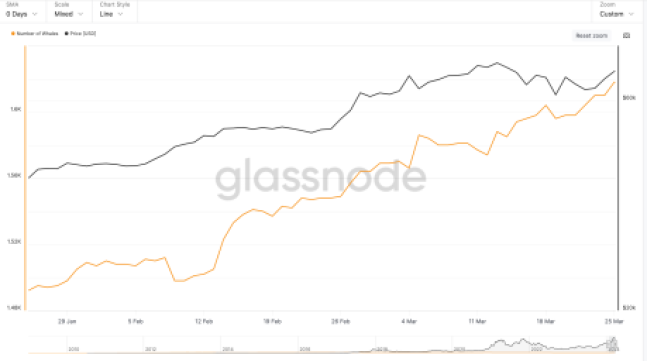

Bitcoin Whales Buy the Dip

As Bitcoin’s price dipped, whales (large investors holding at least 1,000 BTC) jumped at the chance to buy more at lower prices. Since January, the number of wallets with 1,000+ BTC has steadily increased.

Institutional Interest Drives Whale Activity

Institutional investors have poured billions into Spot Bitcoin ETFs, which require issuers to hold the BTC they sell. This has led to institutions buying up a significant portion of the supply.

Spot ETF Inflows Surge

After a week of outflows, inflows into Spot Bitcoin ETFs have rebounded. Tuesday saw a massive 2,600% increase, bringing in $418 million.

Whales Expect Price Rise

The increase in whale activity and ETF inflows suggests that large investors expect Bitcoin’s price to rise. They are positioning themselves to maximize their profits.

Price Recovers

Bitcoin’s price has rebounded from last week’s low of $60,000, rising above $70,000. This supports the whales’ decision to acquire more Bitcoin.

High Inflows Bullish for Bitcoin

Historically, high inflows into Spot ETFs have been bullish for Bitcoin’s price. If inflows continue, Bitcoin could reach a new all-time high before the upcoming halving.