Tone Vays, a well-known trader, has a heads-up for Bitcoin enthusiasts: the remarkable surge of Bitcoin might be nearing its end. Sharing his insights in a recent video, Vays, who has a following of over 123,000 on YouTube, predicts a downturn for Bitcoin in January. This expectation coincides with the U.S. Securities and Exchange Commission’s (SEC) decision on the proposals for Bitcoin exchange-traded funds (ETFs) in the spot market.

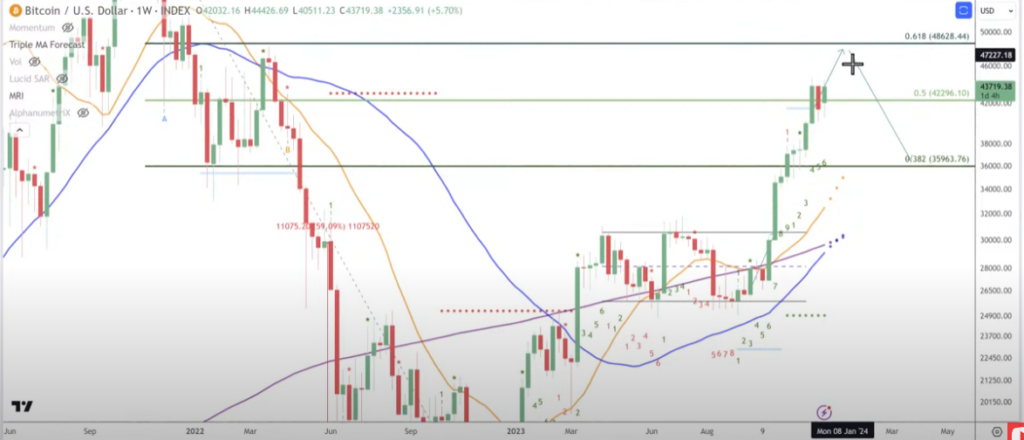

Vays believes that regardless of the SEC’s decision, Bitcoin is poised for a “sell-the-news” event. He’s eyeing a peak around $48,000 in mid-January, which he aligns with a possible rejection of the Bitcoin ETF. Even if the ETF is approved, Vays still anticipates a market pullback when the news breaks.

Source: Tone Vays/YouTube

Explaining his rationale, Vays points out that Bitcoin has seen an extraordinary climb this year, with a 200% increase. According to him, such a steep rise usually leads to a significant correction. If Bitcoin does reach the anticipated $48,000 high, he expects a market sell-off.

Tone Vays, a well-known trader, has a heads-up for Bitcoin enthusiasts: the remarkable surge of Bitcoin might be nearing its end. Sharing his insights in a recent video, Vays, who has a following of over 123,000 on YouTube, predicts a downturn for Bitcoin in January. This expectation coincides with the U.S. Securities and Exchange Commission’s (SEC) decision on the proposals for Bitcoin exchange-traded funds (ETFs) in the spot market.

Vays believes that regardless of the SEC’s decision, Bitcoin is poised for a “sell-the-news” event. He’s eyeing a peak around $48,000 in mid-January, which he aligns with a possible rejection of the Bitcoin ETF. Even if the ETF is approved, Vays still anticipates a market pullback when the news breaks.

Explaining his rationale, Vays points out that Bitcoin has seen an extraordinary climb this year, with a 200% increase. According to him, such a steep rise usually leads to a significant correction. If Bitcoin does reach the anticipated $48,000 high, he expects a market sell-off.

However, Vays also notes a potential rally, but only under a specific scenario: if Bitcoin’s value drops to about $35,000 before the SEC’s announcement. In such a case, a positive decision by the SEC could significantly boost Bitcoin’s value. But if Bitcoin remains around $48,000, Vays maintains that the market is more likely to react negatively to the news.

However, Vays also notes a potential rally, but only under a specific scenario: if Bitcoin’s value drops to about $35,000 before the SEC’s announcement. In such a case, a positive decision by the SEC could significantly boost Bitcoin’s value. But if Bitcoin remains around $48,000, Vays maintains that the market is more likely to react negatively to the news.

Bitcoin is trading for $43,172 at time of writing.