Bitcoin is on fire, reaching new all-time highs, and everyone’s getting in on the action. But while the hype is real, some experts are starting to see signs of a potential cool-down.

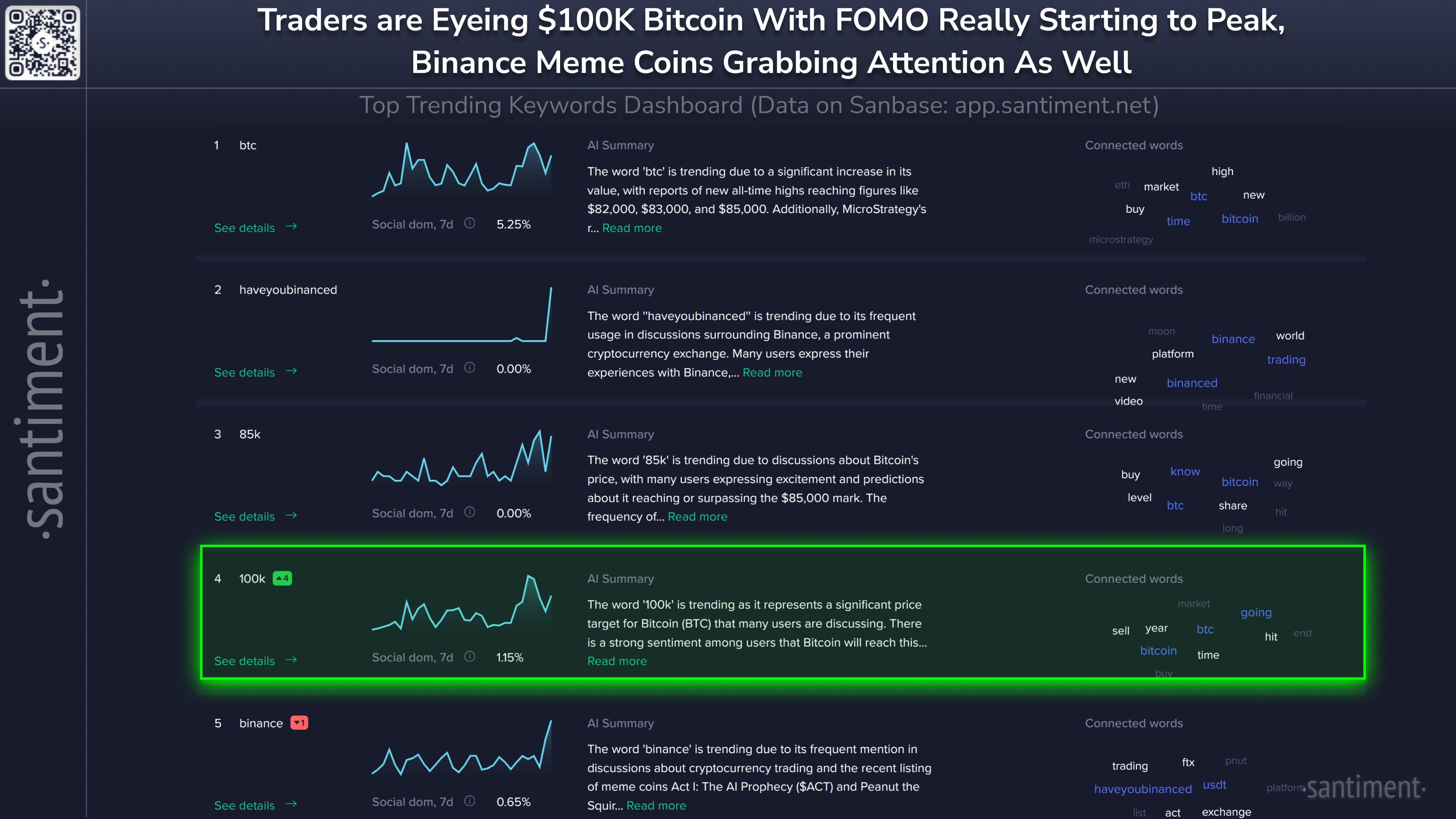

FOMO is peaking

According to Santiment, a crypto analytics firm, the fear of missing out (FOMO) is reaching its peak as investors anticipate Bitcoin hitting the $100,000 mark. This surge in optimism comes after Bitcoin’s impressive 70% jump since its August crash.

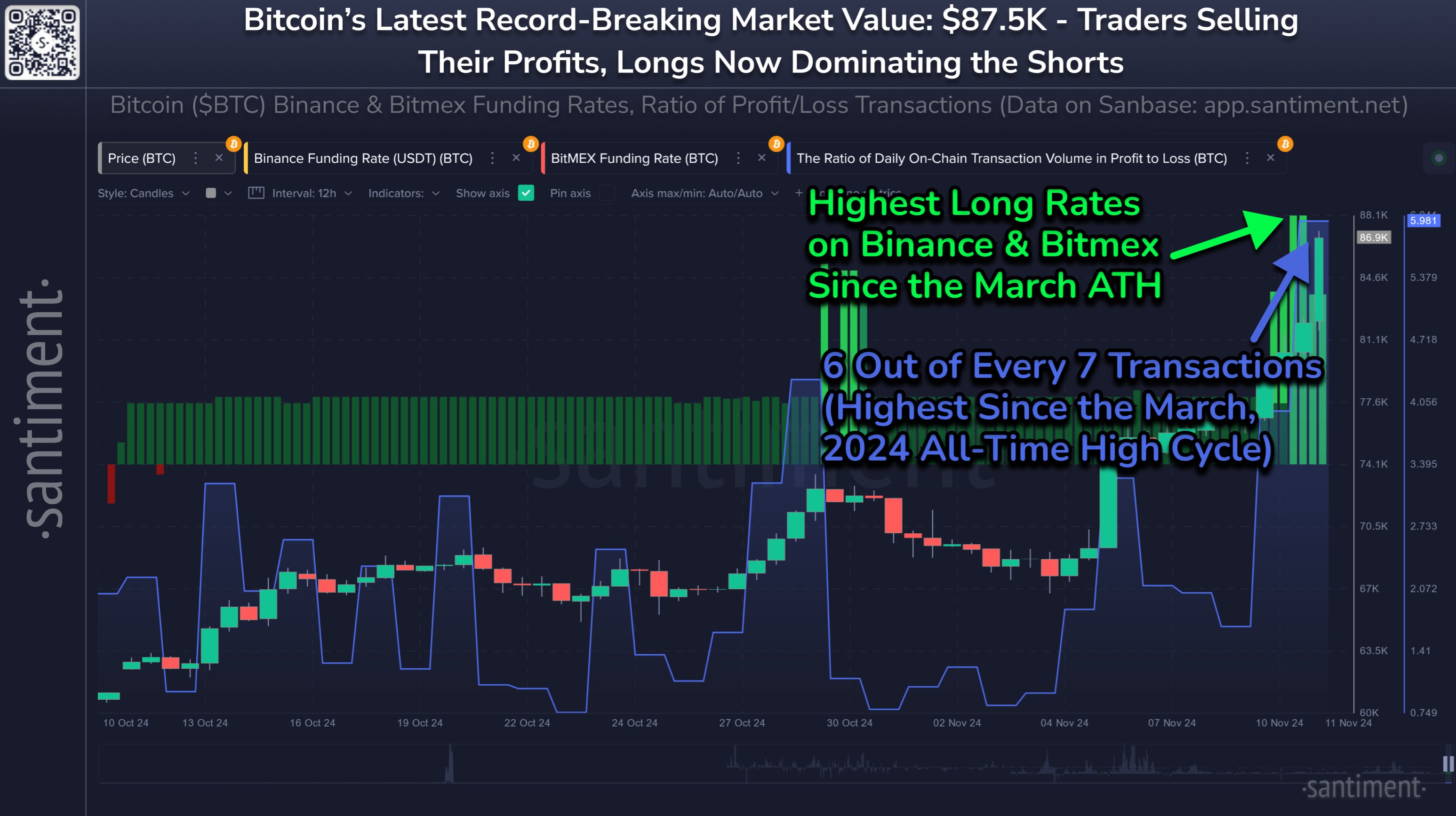

Whales are cashing out

While retail investors are piling into Bitcoin, some big players, known as “whales,” are taking profits. Santiment noticed a massive spike in profit-taking transactions as these whales sell their Bitcoin at the top.

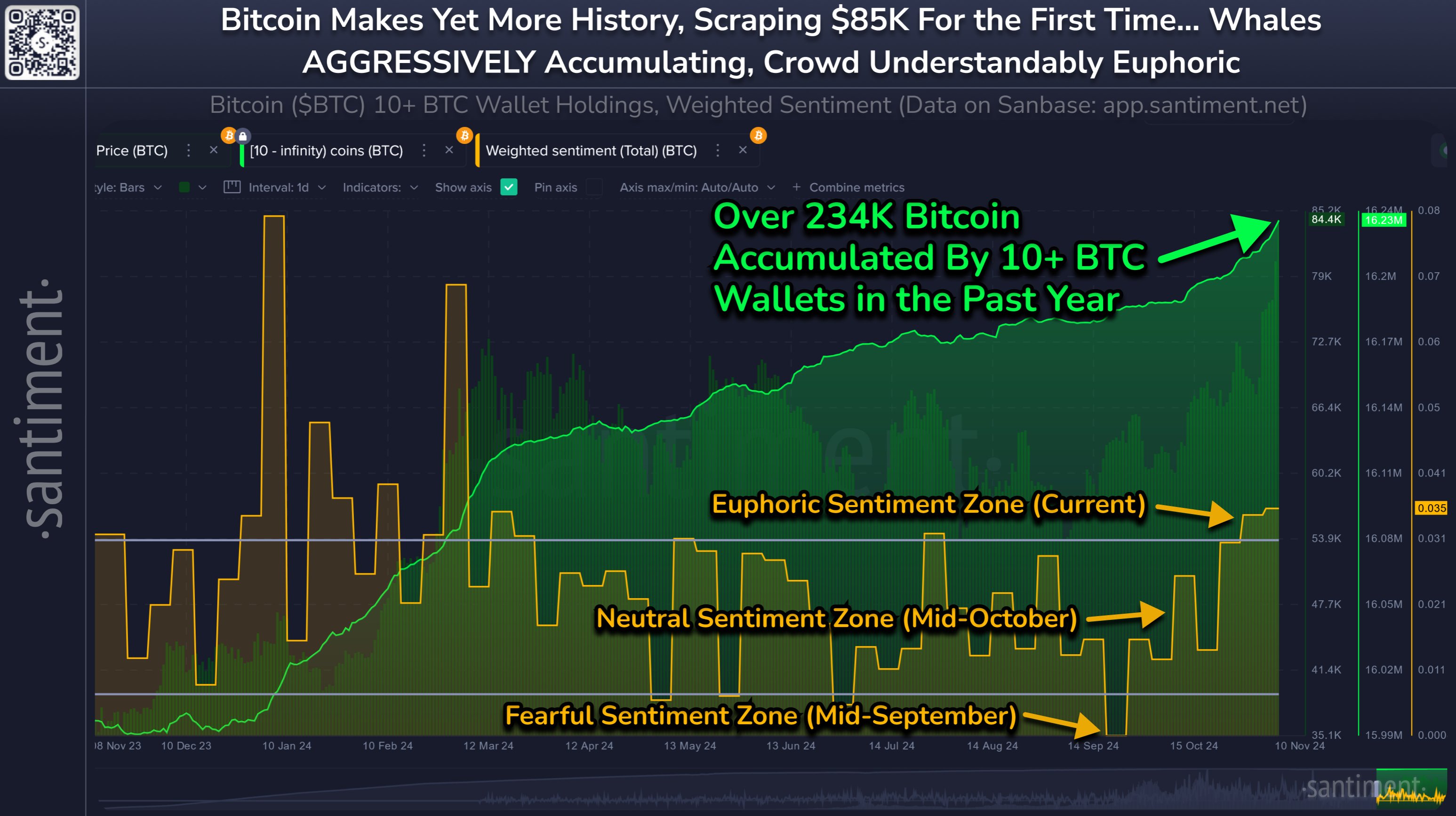

Big players are still buying

Despite the profit-taking, Santiment believes Bitcoin could still climb higher as long as whales continue to accumulate. Over the past year, these big players have added a whopping $19.76 billion worth of Bitcoin to their wallets.

The bottom line

While Bitcoin’s recent surge is exciting, it’s important to remember that the market is volatile. The current FOMO could lead to a correction, especially if whales continue to sell. However, as long as big players keep buying, Bitcoin has the potential to reach even higher levels.

Disclaimer: This information is for educational purposes only and should not be considered investment advice.

/p>