Bitcoin took a nosedive, wiping out its Christmas gains. Could social media hype have predicted this crash?

The Christmas Rally and the Subsequent Drop

Bitcoin almost hit $100,000 on Christmas Day, exciting many investors. But things quickly changed, with the price plummeting towards $95,000. Several factors likely contributed, but social media sentiment might be a key player.

Social Media Sentiment: A Leading Indicator?

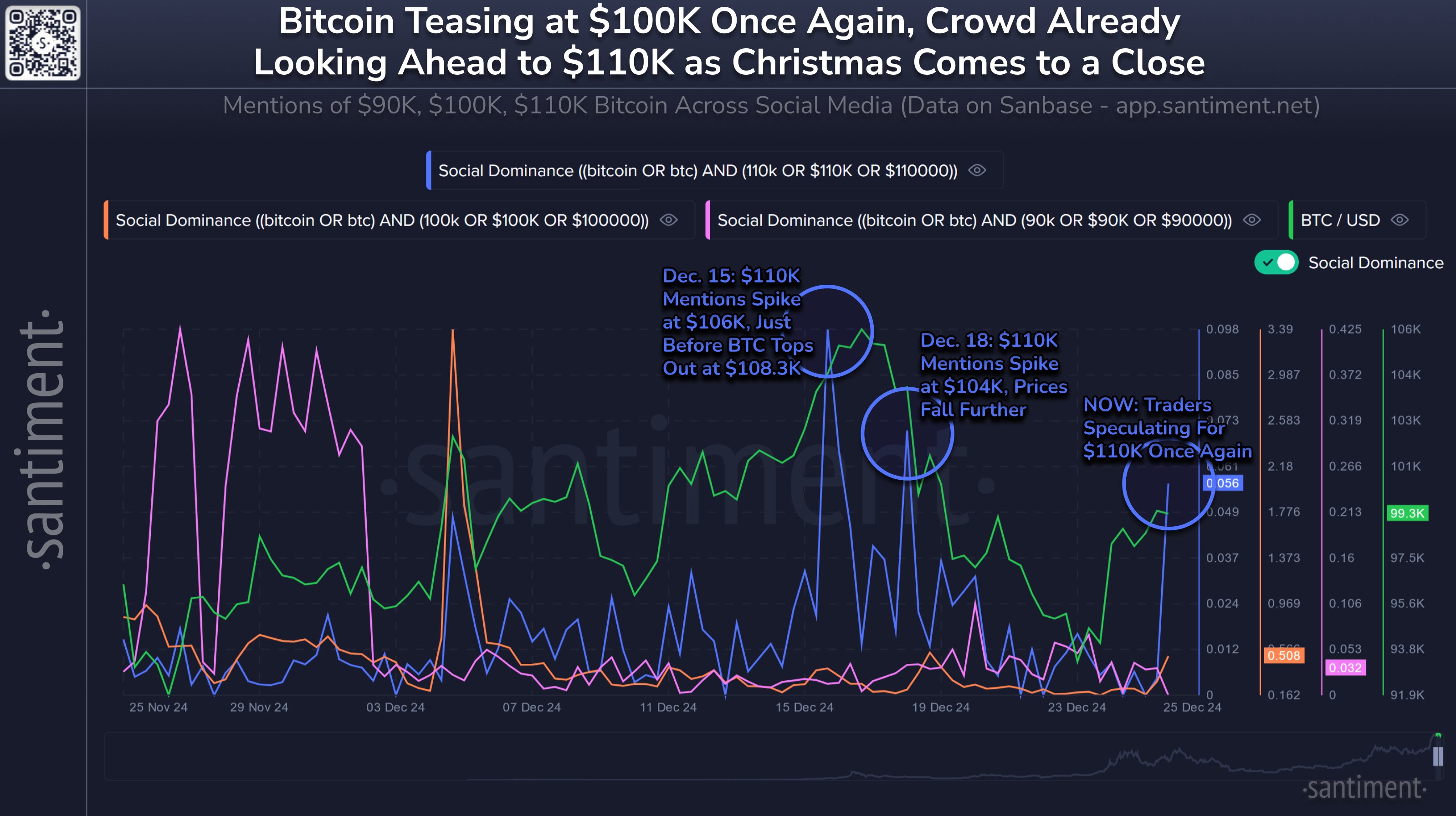

Analytics firm Santiment tracked social media chatter using a metric called “Social Dominance.” This measures the percentage of overall crypto social media conversations focused on specific topics. Santiment analyzed mentions of Bitcoin price targets ($90,000, $100,000, and $110,000) to gauge sentiment.

- Mentions of $90,000 suggested bearish sentiment (expecting a price drop).

- Mentions of $100,000 indicated neutral sentiment.

- Mentions of $110,000 reflected bullish sentiment (expecting a price increase).

The Hype Cycle

A chart of Bitcoin’s Social Dominance for these price targets over the past month showed a significant spike in mentions of $110,000 during the recent rally. This indicated widespread bullishness and expectations of continued growth to a new all-time high.

Historically, Bitcoin’s price often moves against the prevailing crowd sentiment. The stronger the collective belief in a particular direction, the higher the probability of a price reversal. While some optimism is healthy, excessive hype can increase the chances of a crash. The chart also revealed two earlier spikes in $110,000 mentions, both followed by Bitcoin price drops.

The Current Situation

At the time of writing, Bitcoin is trading around $96,100, down almost 4% in the last week. The recent crash seems to support the idea that overly bullish social media sentiment can be a warning sign.