Bitcoin has been surprisingly calm lately, even with the US stock market tanking. While blue-chip stocks have taken a beating, Bitcoin’s price has stayed relatively stable. But is this calm before the storm?

Is Bitcoin Sales Pressure Building?

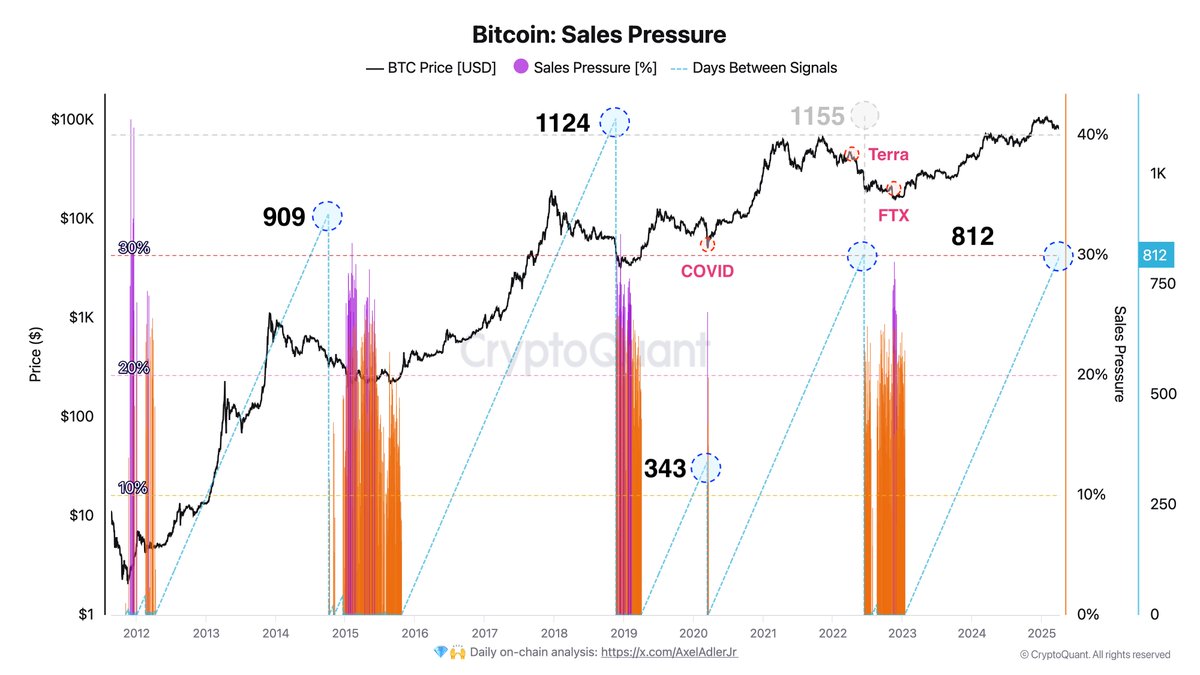

Crypto analyst Axel Adler Jr. thinks so. He’s been looking at a model that combines two key metrics: Net Unrealized Profit/Loss (NUPL) and Spent Output Profit Ratio (SOPR). This model helps predict when long-term Bitcoin holders might start selling, often signaling a market peak or the beginning of a downturn.

According to Adler Jr.’s analysis, significant selling pressure usually emerges after around 800 days of a bull market. The model has now hit that 800-day mark, raising concerns.

Why Bitcoin’s Still Hanging In There

Despite this warning sign, Bitcoin’s price has remained strong. Adler Jr. suggests this resilience is due to a few factors:

- Institutional buying: Big investors are still buying Bitcoin.

- Lack of spot market selling: There’s not a lot of selling pressure in the main Bitcoin market.

- Neutral futures market: The futures market (where people bet on future prices) isn’t showing strong bearish signals.

The Broader Economic Picture

The overall economic climate is pretty gloomy. The VIX (a measure of market volatility) is above 30, and the S&P 500 is down over 4%. These are historically bad signs for the stock market. In response, there are calls for the Federal Reserve to boost the economy again. Adler Jr. points out that this could help the market, but there’s no guarantee.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading around $83,350, up about 1% in the last 24 hours. But the longer-term outlook remains uncertain.