Bitcoin’s been king of the crypto hill lately, even with prices bouncing around. But one analyst, Seth, thinks Bitcoin needs to loosen its grip for the next big bull run to happen.

Bitcoin’s Dominance: Too Much of a Good Thing?

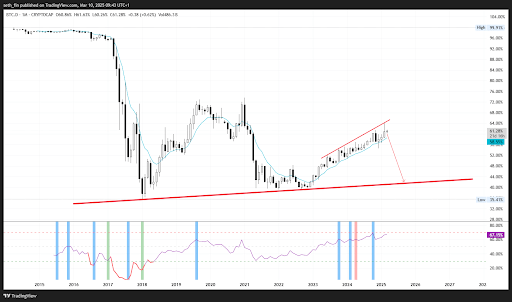

Seth’s looking at Bitcoin’s dominance, specifically its Relative Strength Index (RSI). Think of RSI as a gauge of how fast and how much a price is changing – it helps spot when something’s overbought or oversold. Bitcoin’s monthly dominance RSI just hit a record high of 70. That’s usually a good sign, right? Not this time, says Seth. He thinks this super-high RSI means Bitcoin’s dominance is unsustainable and could actually slow down the whole market.

He argues that this isn’t just a Bitcoin thing; it’s a basic market principle. If one thing dominates too much, it can stifle growth elsewhere.

The Need for a Bitcoin Cool-Down

Seth predicts a healthy correction. He thinks Bitcoin’s dominance needs to drop to around 44%. Why? Because a drop means more money will flow into other cryptocurrencies (altcoins), boosting their prices.

Historically, big Bitcoin gains have been followed by altcoin rallies. This is usually the final stage of a bull run. Until Bitcoin’s dominance cools off, altcoins will likely struggle, preventing that final push upwards.

Current Market Conditions

Right now, Bitcoin is trading around $81,500, down slightly. Its dominance is at 61%, up a bit in the last 24 hours. This shows that money is still mostly parked in Bitcoin, which Seth says needs to change for the next bull run to really take off.