Bitcoin is making waves in the financial world, and things are looking good for the future, especially in the US. According to analyst Mike Colonnesse, there are several factors pointing towards a bright future for Bitcoin and the mining industry.

Trump’s Crypto Agenda: A Boost for Bitcoin?

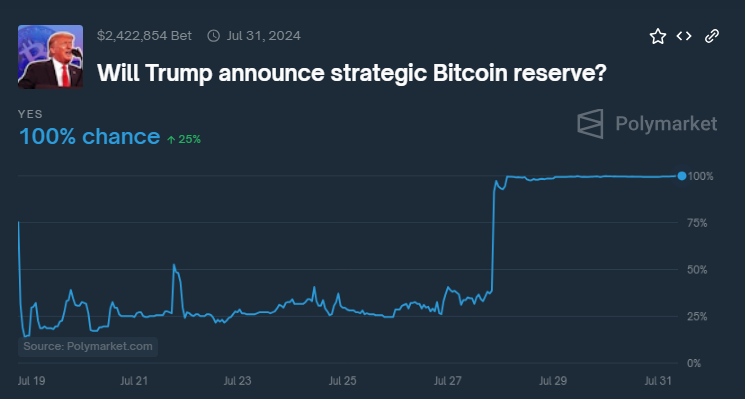

Former President Donald Trump has been vocal about his support for cryptocurrencies, particularly Bitcoin. He’s even talked about making the US a global leader in Bitcoin mining and setting up a government bank with a hefty Bitcoin reserve. While these ideas are still in the early stages, they could have a big impact on the crypto market.

Trump’s support, along with other politicians like Senator Lummis and Robert F. Kennedy, could bring more attention to cryptocurrencies and encourage wider adoption. If Trump were to win the next election, his plans for a Bitcoin reserve could lead to even more institutional investment and solidify Bitcoin’s position as a national asset.

Regulatory Changes on the Horizon?

Another potential game-changer is the possibility of a new SEC chairman. Current chairman Gary Gensler has been known for his tough stance on crypto, but a new leader could bring a more favorable regulatory environment. This could lead to less restrictive rules and a boom in innovation and growth for the entire crypto space.

Factors Driving Bitcoin’s Price

With increased institutional interest, potential regulatory changes, and the natural scarcity of Bitcoin, the price is likely to rise. Bitcoin’s price typically goes up after halving events, which reduce the rate at which new Bitcoins are created. This scarcity, combined with institutional demand, could push prices even higher.

Bitcoin’s price typically goes up after halving events, which reduce the rate at which new Bitcoins are created. This scarcity, combined with institutional demand, could push prices even higher.

Challenges Ahead

While the future looks bright, there are some challenges to consider. These include:

- Legal and regulatory uncertainty: Governments around the world are still figuring out how to regulate cryptocurrencies. Any major disruptions or bans could hurt the market.

- Environmental concerns: Bitcoin mining is energy-intensive, which has raised environmental concerns. Finding solutions to these issues will be crucial for the long-term success of Bitcoin.

- Market volatility: The crypto market is known for its volatility. This can be both a risk and an opportunity for investors.

Despite these challenges, Bitcoin’s economy is growing. With continued innovation and a supportive regulatory environment, Bitcoin could become a major force in the global financial system. /p>