Bitcoin’s price is causing some serious debate among analysts. While some see a potential crash looming, others remain bullish. Let’s dive into the different perspectives.

Bearish Signals: A Potential Crash?

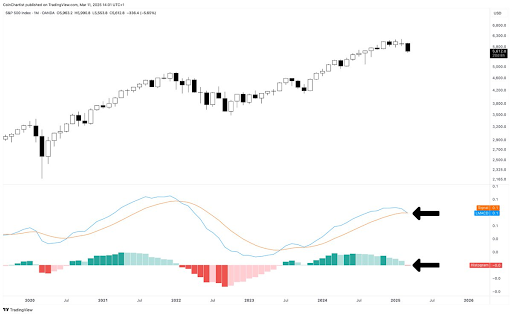

Analyst Tony Severino is sounding the alarm. He points to a bearish signal from the S&P 500’s monthly LMACD indicator. Since Bitcoin’s price is closely tied to the stock market, this is a significant warning sign. The indicator’s shift to bearish, coupled with a red histogram, suggests a potential price drop for Bitcoin.

Severino gives Bitcoin bulls a 20-day window to change the narrative. If the price doesn’t reverse course, a significant crash – potentially worse than recent declines – could be on the horizon. He even warns of a potential “Black Swan” event, referencing similar situations in the past. Remember, Bitcoin recently dipped as low as $76,000.

Bullish Arguments: Why Hope Remains

However, not everyone is panicking. BitMEX co-founder Arthur Hayes believes the bull market is far from over. He points out that Bitcoin’s ~30% correction from its all-time high is typical during bull runs. He predicts a rebound once the Federal Reserve eases its monetary policies.

Analyst Kevin Capital shares a similar optimistic outlook. He sees Bitcoin’s recent performance as perfectly on track. While he acknowledges a potential dip to the $70,000-$75,000 range, he doesn’t see this as a major cause for concern. He believes Bitcoin can stay afloat if key market structures hold and the 3-day MACD resets. Positive economic news, like slowing inflation, could also provide a boost.

The Current Situation

At the time of writing, Bitcoin is trading around $81,860, showing a slight increase over the past 24 hours. The next few weeks will be crucial in determining whether the bearish predictions or the bullish optimism will prevail. The upcoming US CPI data will be a key factor to watch.