Is Bitcoin headed for a bull run or a bear market? Experts are divided.

A Bearish Outlook

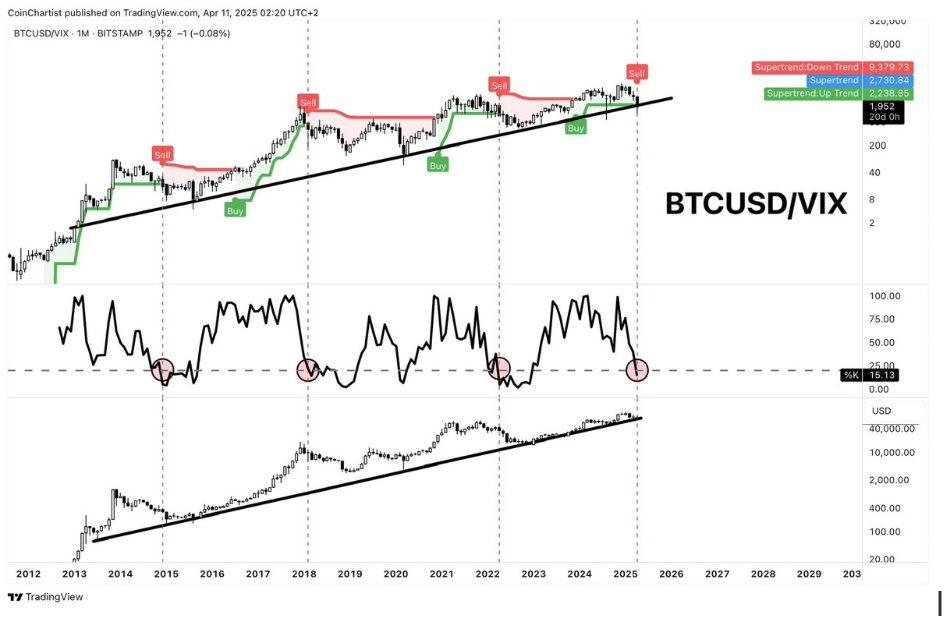

Technical analyst Tony Severino isn’t convinced the Bitcoin market is as rosy as some influencers suggest. He’s looking at the Bitcoin/VIX indicator and seeing signals typically associated with bear markets. While he acknowledges the month isn’t over and things could change, his current analysis is bearish. Severino previously voiced concerns about Bitcoin’s price chart, citing technical indicators suggesting a potential market peak.

A Bullish Counterpoint

Other analysts offer a more optimistic perspective. Analyst Saeed, for example, views the current correction as a healthy retracement within a larger bullish trend. He sees $85,000 as a key level; breaking above it could signal new highs.

Macroeconomic Factors

The macroeconomic climate also plays a role. Recent inflation data has been better than expected, fueling hopes for a Federal Reserve rate cut. This, along with potential Federal Reserve intervention to stabilize markets (especially with ongoing trade tensions), could inject more liquidity into the crypto market, potentially boosting Bitcoin.

Technical Analysis: The Mixed Signals

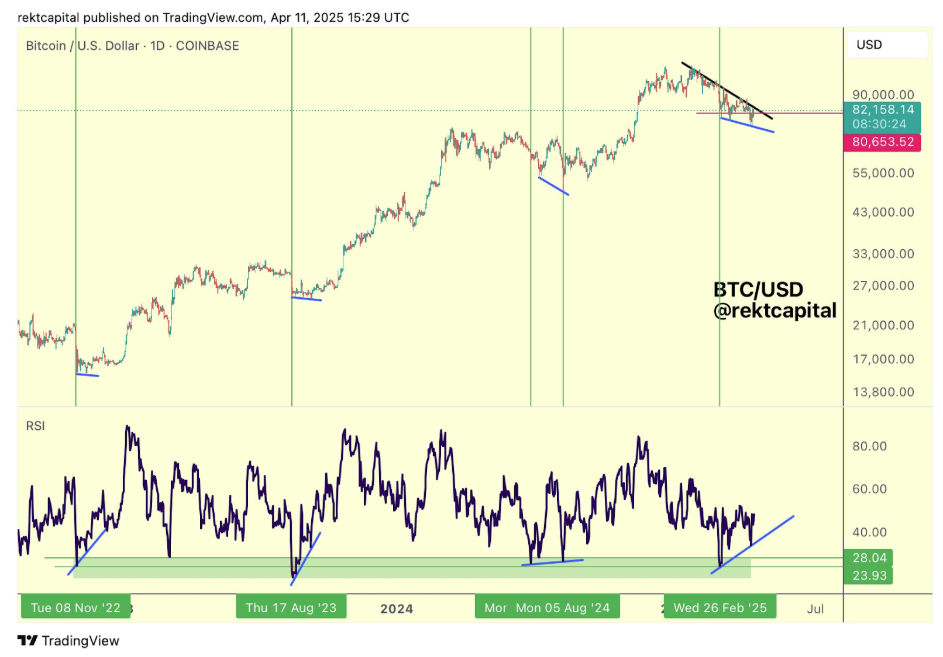

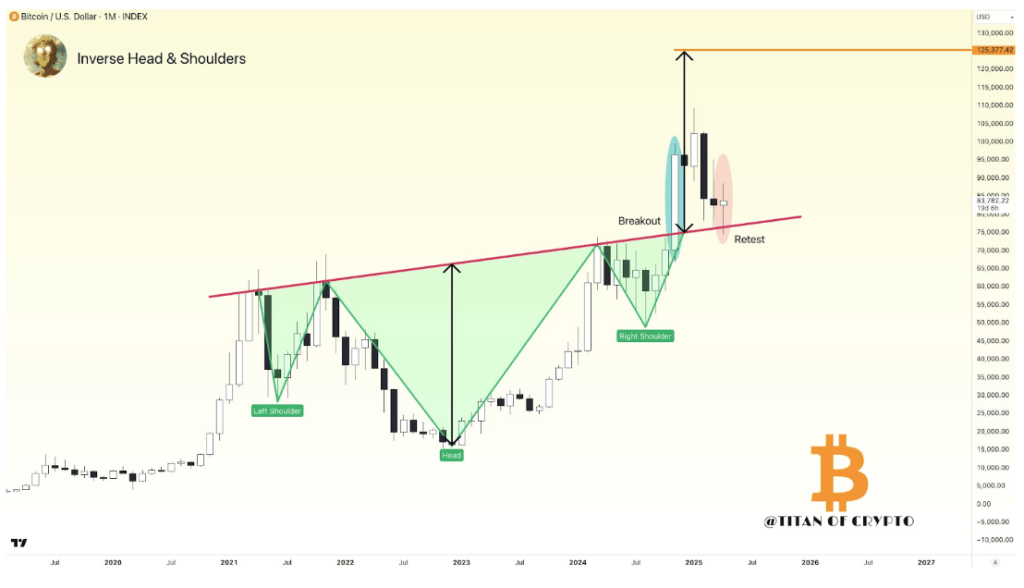

The technical picture is mixed. Analyst Titan of Crypto sees a potential inverse Head-and-Shoulders pattern forming, which could propel Bitcoin to $125,000. However, it’s still early days, and it could just be a retest. Meanwhile, Rekt Capital points to a bullish divergence on the RSI, suggesting a potential upward reversal. Historically, similar divergences have preceded Bitcoin price rallies.

Current Price and Conclusion

At the time of writing, Bitcoin is trading around $83,400, up slightly. The overall outlook remains uncertain, with conflicting signals from various technical indicators and expert opinions. Whether Bitcoin continues its upward trajectory or enters a bear market remains to be seen.