Is Bitcoin in trouble? Some analysts are worried, while others remain optimistic. Let’s break down the conflicting viewpoints.

The Bearish Warning

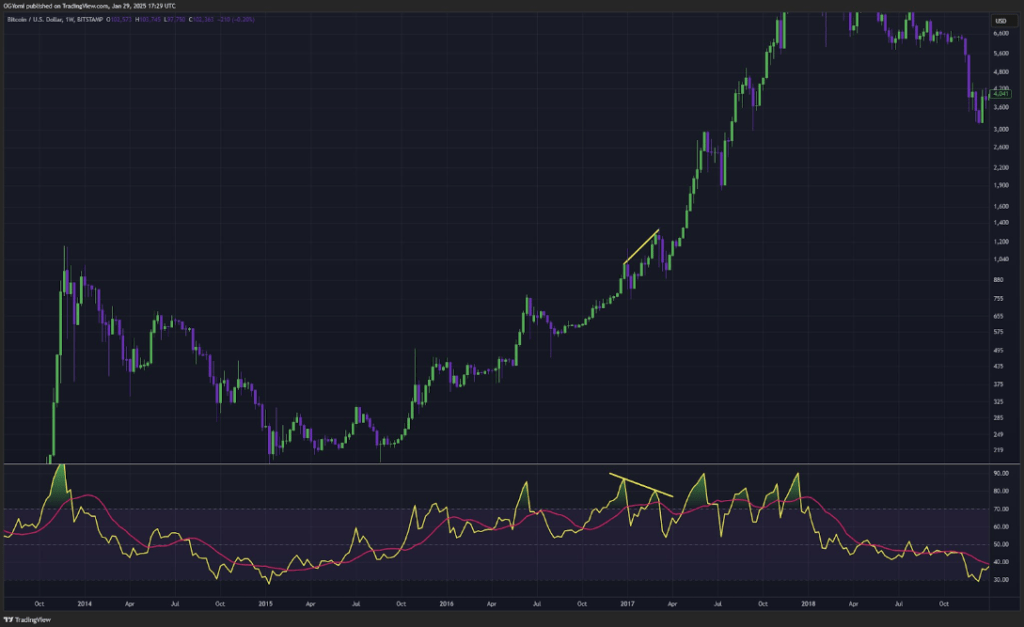

Analyst Kevin Capital spotted a bearish pattern on Bitcoin’s weekly chart – a “bearish divergence” – that mirrors one seen before a major market crash. He’s concerned, calling this the only chart that keeps him up at night. While acknowledging the potential for a downturn, he also points out that Bitcoin recovered after a similar crash last time. So, while he advises caution, he’s not sounding the alarm bells just yet.

The Bullish Counterarguments

However, not everyone is worried. Several analysts are offering a more positive outlook:

-

Titan of Crypto:

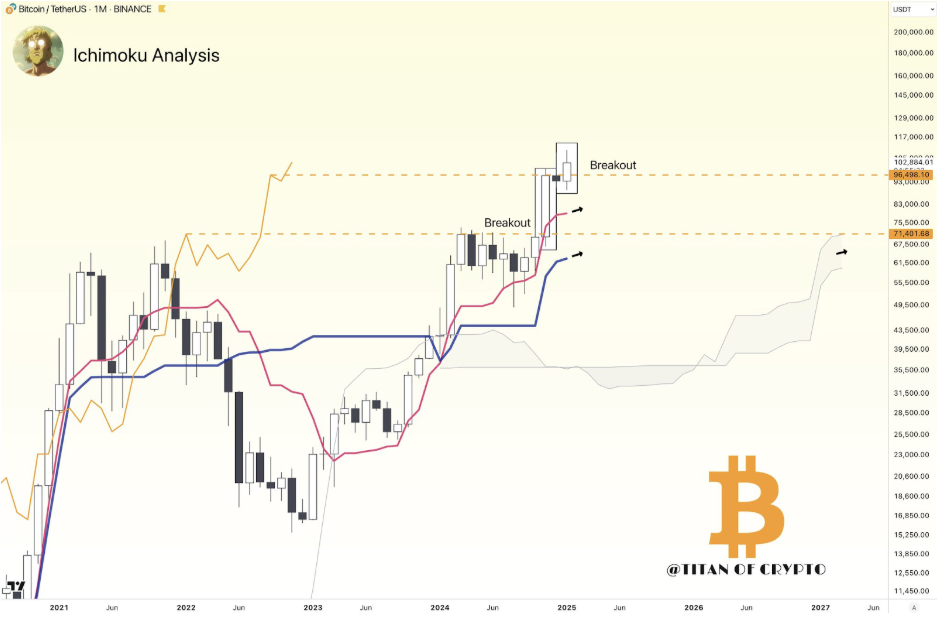

Believes Bitcoin is entering a significant price increase, predicting a potential rally to $117,000. He sees the recent consolidation as a temporary pause.

Believes Bitcoin is entering a significant price increase, predicting a potential rally to $117,000. He sees the recent consolidation as a temporary pause. -

CobraVanguard: Points to a “cup-and-handle” formation on the chart, a bullish pattern suggesting a move towards $123,000, potentially even reaching $260,000 this cycle.

-

Mikybull Crypto:

Highlights a strong January monthly close, invalidating a bearish signal and suggesting the market peak is still to come. He forecasts a potential rally to $144,129.

Another analyst, Titan of Crypto, also noted a strong Ichimoku chart for Bitcoin, with upward trends and price holding above key support levels. February is historically a good month for crypto, adding to the bullish sentiment.

The Current Situation

Currently, Bitcoin is trading around $102,400, down slightly in the last 24 hours. The conflicting signals from analysts leave the market’s direction uncertain. It’s a classic case of bulls versus bears, and only time will tell who’s right.