Kiyosaki Predicts a Crash

Financial guru Robert Kiyosaki thinks the new Trump tariffs could send Bitcoin, gold, and silver prices plummeting. He tweeted that the market volatility caused by these tariffs could trigger a price crash, but added that this would be a great buying opportunity for savvy investors. He sees market crashes as sales, a chance to scoop up assets at bargain prices.

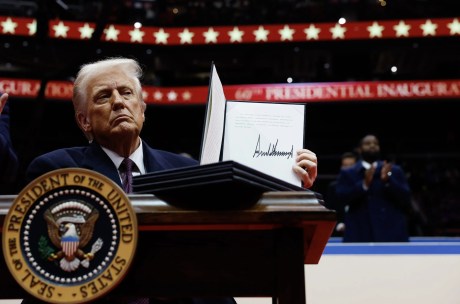

What’s the Deal with the Tariffs?

The Trump administration recently announced significant tariffs on imports from Canada, Mexico, and China. These tariffs are intended to address issues like fentanyl trafficking, but they’ve already rattled stock markets.

Bitcoin’s Price: A Closer Look

Bitcoin’s price is currently hovering above $100,000, but it’s seen a recent dip. Blockchain analytics firm Glassnode points out a high concentration of Bitcoin trading between $94,000 and $101,000 recently. They suggest that $98,000 could act as a support level, potentially leading to a price surge if it holds.

More Than Just Tariffs

The impact on Bitcoin goes beyond just the tariffs. Analysts are also watching US jobs data and the ongoing disruption in China’s tech sector, both of which could influence market volatility. The overall economic climate plays a significant role in crypto prices.

Another Analyst’s Take

Crypto analyst Arthur Hayes agrees with Kiyosaki about potential volatility. He even predicts a “mini financial crisis” that could send Bitcoin down to $70,000, followed by a rebound to $250,000.

The Bottom Line

The future of Bitcoin’s price is uncertain. While some experts predict a significant drop due to the new tariffs and broader economic factors, others see it as a buying opportunity. The coming weeks will be crucial in determining which prediction proves more accurate.