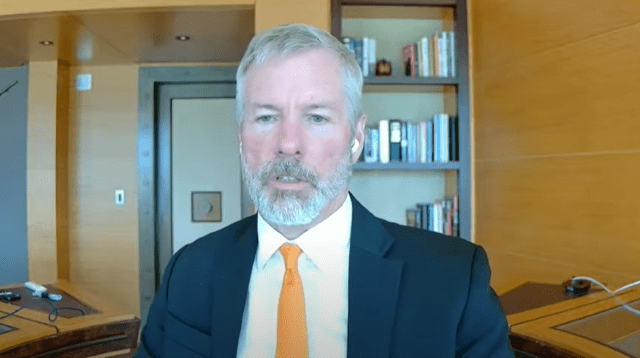

Michael Saylor, the head of MicroStrategy, predicts a big shift in how Bitcoin is used by 2035. He sees a future where the biggest players—like major banks, tech giants, and governments—dominate Bitcoin’s core network.

Big Tech and Governments Take the Lead

Saylor envisions a scenario where companies like Apple, Google, Microsoft, and major banks (Citi, Bank of America, etc.) are the main users of Bitcoin’s base layer. They’ll be moving massive amounts of Bitcoin between each other for settlements. Even payment networks like Visa will be heavily involved. He believes the base layer will handle transactions between large institutions, while everyday users will interact with Bitcoin through other layers.

A Layered Approach to Bitcoin

Saylor describes a multi-layered system:

- Base Layer: This is where the big players handle large transactions.

- Layer 2 (Lightning Network): A faster layer connecting many websites and apps.

- Layer 3: This layer will be run by companies like Coinbase, Cash App, and even tech giants like Apple and Microsoft, providing user-friendly services. This is where most users will interact with Bitcoin.

He believes this layered system will allow for billions of transactions, with everyday users mostly interacting through these intermediary services rather than directly with the base layer.

Early Adopters and the Future of Bitcoin

Saylor calls early Bitcoin users “pioneers.” He suggests that those who hold onto their Bitcoin through this transition could become incredibly wealthy. Conversely, those who sell too early might regret it. His prediction is based on the idea that Bitcoin will become a primary store of value (like digital gold) for corporations and governments, not just a daily currency. Fiat currencies will still be used for everyday transactions.

The Bottom Line

Saylor’s vision is a future where Bitcoin’s core is controlled by massive institutions, with regular users interacting through easier-to-use platforms. This represents a significant shift from the current decentralized model. At the time of this writing, Bitcoin was trading at $117,363.