Bitcoin has been on a roll lately, with its price surging over 10% in the past week and breaking back above $67,000. This bullish momentum has even led to a “greed” signal on the Coinmarketcap Fear And Greed Index.

Bitcoin Exchange Reserves Drop to a 5-Year Low

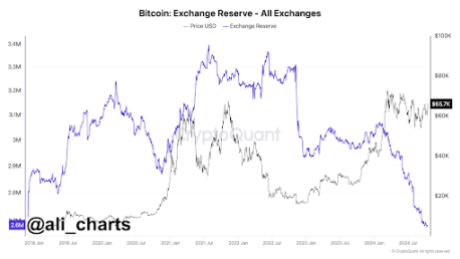

The recent buying frenzy has led to a significant drop in the amount of Bitcoin held on exchanges. According to on-chain data, the Bitcoin exchange reserve has fallen to its lowest point in five years, reaching just 2.6 million BTC.

This decline in exchange reserves can be attributed to a few key factors:

- Institutional Interest: The approval and growing popularity of Spot Bitcoin ETFs have attracted a lot of institutional investors, leading to increased buying activity.

- Long-Term Holders: Many long-term Bitcoin holders have also been buying, further increasing demand.

- Price Corrections: Even during periods of price corrections, short-term holders have been selling their Bitcoin, moving it into the hands of long-term holders who are less likely to sell.

This drop in exchange reserves, which is the lowest level since January 2019, is generally seen as a bullish sign for Bitcoin.

What Does This Mean for Bitcoin’s Price?

The current state of Bitcoin’s exchange reserves suggests that market participants are holding onto their Bitcoin, anticipating future gains. This reduced selling pressure, combined with continued demand, could push the price of Bitcoin even higher.

With Bitcoin already up 6.3% in October, it’s on track to potentially break its all-time high of $73,737 before the end of the month.