Bitcoin took a recent dive, but don’t count it out just yet! One analyst thinks it’s still got a long way to climb.

$200,000 Bitcoin: A Realistic Goal?

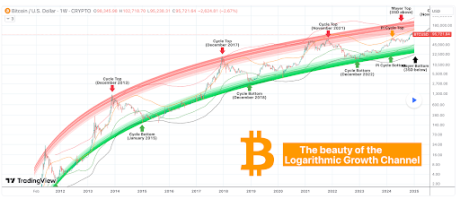

TradingShot, a crypto analyst, predicts Bitcoin could hit a whopping $200,000 this cycle. He acknowledges the recent volatility and points out that this year is likely the last year of this bull run. But he doesn’t see the recent crash as a sign of the peak. Instead, he thinks the top of the market might form around November, based on past trends. Previous peaks have often occurred in November or December.

His prediction is based on historical patterns, including the Pi Cycle Top and the LGC (Long-term Growth Cycle) zones. Even if Bitcoin only briefly tests the bottom of the LGC 2nd Zone by November 2025, he still believes it could reach close to $200,000. His projected peak zone is between $180,000 and $200,000 – a range he considers plausible, even if slightly below the Pi Cycle Top. It’s worth noting that Standard Chartered and Bernstein analysts have also made similar predictions, with Bernstein even calling $200,000 a “conservative” estimate.

Signs of a Bitcoin Price Rebound?

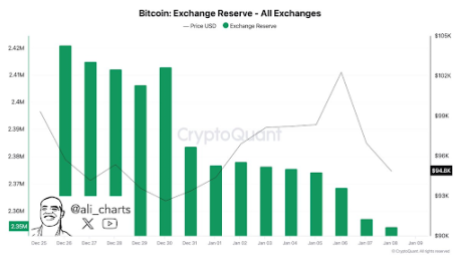

Bitcoin’s start to the year has been rough, dropping as low as $93,000. But there’s some good news, according to analyst Ali Martinez.

He highlights two key points suggesting a potential rebound:

-

Whale Accumulation: Over 22,000 BTC (worth over $2.1 billion) were withdrawn from exchanges last week. This large-scale accumulation by “whales” (large investors) often precedes price increases.

-

Shifting Sentiment: A significant portion (63.92%) of Binance traders have switched from shorting (betting against) Bitcoin to going long (betting on its rise) after the price dipped below $100,000. This change in sentiment is another bullish signal.

While Bitcoin was trading around $93,000 at the time of writing (down over 2% in 24 hours), these indicators suggest a price recovery might be on the horizon.