Bitcoin’s been on a rollercoaster lately, with lots of price swings and selling. This is happening because of all the uncertainty in the global economy. Things like political tension and unpredictable government decisions (especially from the US) are making investors nervous, and that nervousness is hitting cryptocurrencies like Bitcoin.

A Buying Opportunity?

Despite the chaos, many experts think this dip is just a normal part of the market cycle. They believe the current situation might actually be a good thing, leading to a price reset. Interestingly, the data suggests this might be the case.

Selling Pressure Eases

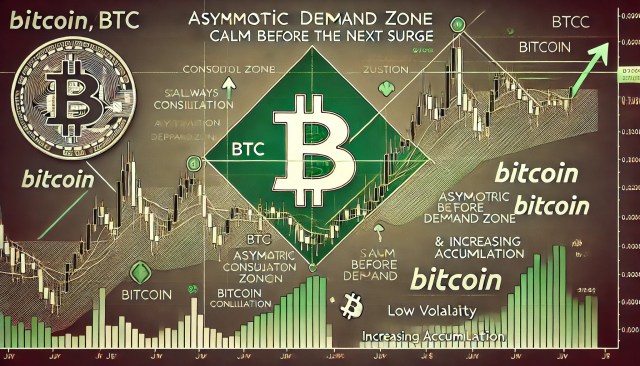

According to CryptoQuant, the amount of Bitcoin being sold on major exchanges has dropped dramatically – from 81,000 BTC per day to just 29,000 BTC. This huge decrease shows that the market has absorbed a lot of the selling that happened after Bitcoin went above $100,000. Analysts are calling this a “zone of asymmetric demand,” meaning sellers are drying up, and buyers are feeling more confident.

Holding the Line at $81,000

Bitcoin is currently hovering around $81,000, a crucial support level. If it falls below this, we could see more selling and a bigger price drop. The overall economic climate is still pretty tense, and new government policies add to the uncertainty. President Trump’s recent announcements, for example, have markets on edge.

However, looking at the data again, the average daily selling pressure is way down (from 81,000 BTC to 29,000 BTC). This “zone of asymmetric demand” suggests buyers are feeling more confident. This could mean we’re in a consolidation phase – a quiet period before a big price move.

The $86,500 Hurdle

Bitcoin is currently trading around $84,200. The next big test is breaking through $86,500. This level is important because it lines up with the 200-day moving average and the 200-day exponential moving average. Breaking through this would be a strong signal that Bitcoin is recovering. Failing to do so, however, could mean more downward pressure. The short-term future depends on whether buyers or sellers win this battle.