Bitcoin (BTC) has taken a bit of a tumble this week, testing its support levels. But some analysts think things might look brighter by the weekend.

Bitcoin’s Recent Drop

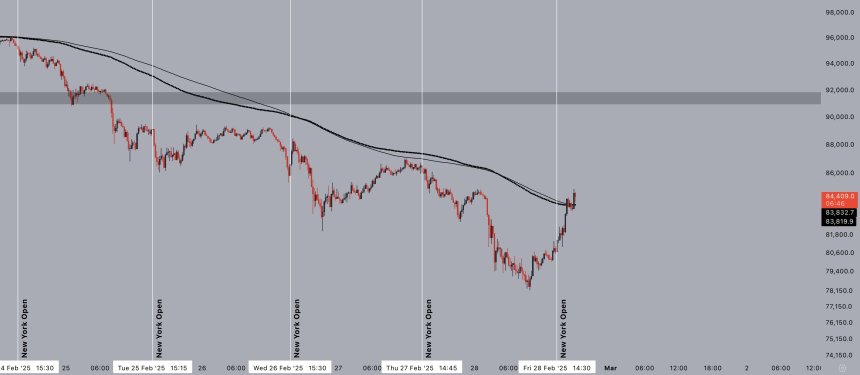

Bitcoin’s price has dropped significantly, falling 21% from last week’s high of $99,000. This drop took it below $80,000 for the first time since November, and even below its price after the US election. It also marked a nearly 30% drop from its all-time high in January. The fall even filled a gap in the market from November 2024.

Despite this, Bitcoin has shown some resilience, rebounding about 7% from its recent lows and currently hovering around $83,000-$84,000. Analysts are watching seller volume closely; high and consistent selling pressure is unsustainable, and a drop in selling could signal a price reversal.

A Weekend Bounce Back?

Analyst Jelle believes a weekend rally is possible. Bitcoin has tested its lows repeatedly this week, and this, combined with the recent rebound, suggests a potential upward swing. Reclaiming the $84,500 support level is crucial; previous attempts to do so failed. However, this time, Bitcoin broke above a key moving average, which could indicate a positive shift. A new price gap around $93,000 is also a factor.

Another analyst, Rekt Capital, notes that Bitcoin has consistently filled previous market gaps. The only remaining gap is between $92,800 and $94,000. If this pattern continues, a price increase to fill this gap is likely. Rekt Capital outlines two scenarios: a quick jump back to around $93,500 by the end of the week, or a slightly slower rise to that level within the next two to three weeks.

Currently, Bitcoin is trading around $85,120. Whether it’ll hit those $93,000 levels soon remains to be seen, but the potential for a weekend rebound is definitely on the table.