Bitcoin’s price has been on a tear lately, but there’s a new wrinkle in the market. Long-term holders, those who have been holding onto their Bitcoin for over a year, are starting to sell.

What’s Going On?

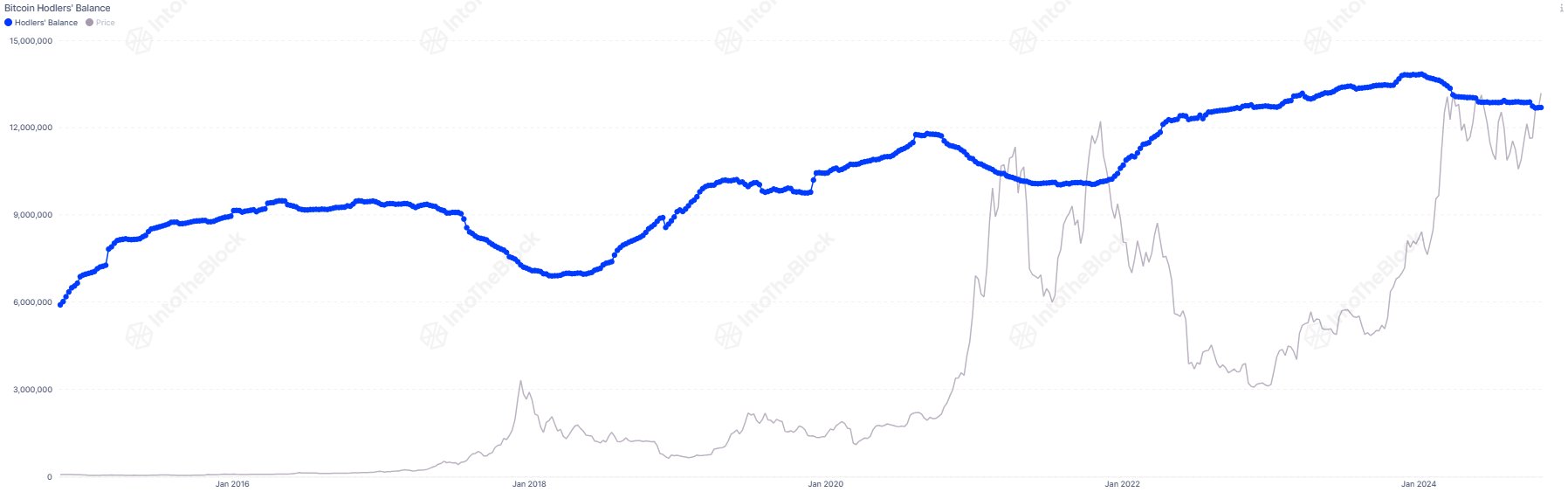

Data shows that these “diamond hands” have been accumulating Bitcoin during the bear market and the recent rally. However, they started selling off their holdings in the first quarter of this year, likely taking profits from their patience.

This selling pressure dried up as Bitcoin consolidated after hitting a new all-time high. But recently, as Bitcoin has surged again, these long-term holders have started selling once more.

Is This a Bad Sign?

Historically, long-term holders have been contrarian indicators. They tend to buy when prices are low and sell when prices are high. While they do time their selling with bull runs, the actual peak of the market usually doesn’t happen until they have been selling for a while.

This suggests that Bitcoin might have some room to run in the current rally before it hits a ceiling.

However, there’s a twist this time. The scale of selling from long-term holders is less intense than in previous bull markets. This could mean that a new dynamic is emerging in the market.

What’s Next?

Bitcoin is currently trading around $68,800, down slightly over the past week. It’s unclear how this new selling pressure from long-term holders will affect the market in the long run.

It’s important to remember that the cryptocurrency market is highly volatile, and anything can happen. Keep an eye on the data and stay informed about the latest developments.