The Bitcoin bull market is taking its sweet time, but that might actually be a good thing. While it’s been slower than some predicted, Bitcoin’s price is still steadily climbing within an upward trend. This delay, however, has pushed potential price targets even higher than initial predictions.

Why a Delayed Bull Market Could Be Positive

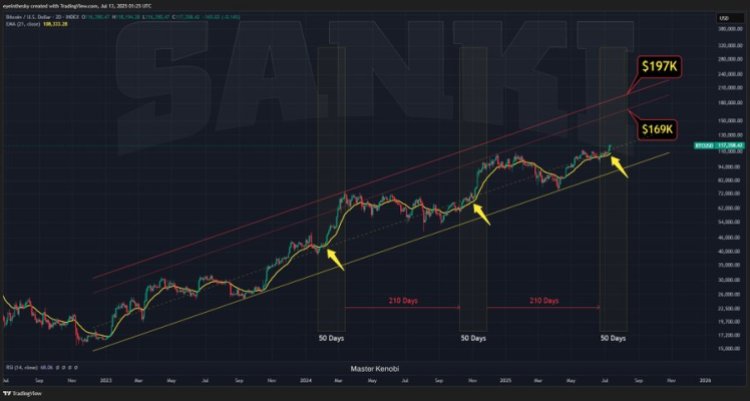

Global uncertainty has slowed down the crypto bull market. But according to one analyst, this delay might benefit us in the long run. Bitcoin and other cryptocurrencies have stayed within a rising trend channel, and even though the market is hesitant, the channel’s upper and lower limits keep rising.

Initially, if the bull market’s second phase had started in April, Bitcoin was projected to reach between $134,000 and $155,000. Since that didn’t happen, the potential high has increased. If a certain price pattern holds, Bitcoin could hit between $169,000 and $197,000 around August 11th. This, of course, depends on things remaining relatively stable globally. The analyst hopes for another month of calm market conditions.

Bitcoin’s Surge: A Ripple Effect Across the Market

Another analyst points out that Bitcoin is poised for a major move. It’s currently within a long-term bullish trend, having just broken through a key resistance level. Historically, a specific indicator (the Stoch Relative Strength Index or RSI) crossing over on the monthly chart has always led to huge price increases. This crossover has just happened, suggesting a significant rally is on the horizon.

This analyst believes that Bitcoin’s price could soar to $180,000-$200,000, potentially peaking in late August or September. This would likely be followed by a surge in altcoins (other cryptocurrencies besides Bitcoin), with the peak of that cycle predicted for late 2025 or early 2026. The analyst also mentions the upcoming NFT season and Bitcoin Ordinals events in 2026. Remember, this is speculation, and it’s always important to invest responsibly.