Bitcoin is currently hanging out near a super important support level – the Bull Market Support Band. Historically, this band has been a lifesaver for Bitcoin during bull runs, acting as a floor where price bounces back up.

Why This Support Level Matters

A crypto trader, Daan Crypto Trades, highlighted Bitcoin’s position right on this support band. This band is a reliable indicator of long-term momentum. While Bitcoin has dipped slightly below this level in the past, it’s never stayed down for long during a bull market (usually only a week or two). As long as Bitcoin keeps making higher highs and higher lows, the overall trend is still positive. Any dips are seen as potential buying opportunities.

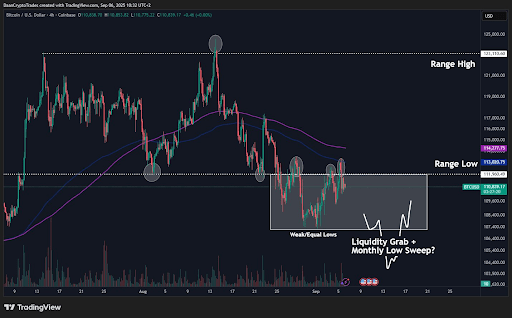

Liquidity and Bitcoin’s Next Move

Things might get a little bumpy in the short term. We’re seeing the first bearish divergence between Bitcoin’s price and the global money supply since the last low. Market expert Saint Pump predicts a liquidity pullback in late September, possibly linked to the Federal Reserve potentially cutting interest rates. This, combined with Bitcoin’s recent price weakness, suggests some choppy trading ahead. October might also be volatile, as it’s the end of a four-year cycle (which usually brings some selling).

Despite this, there aren’t any major signs of a market top. Saint Pump even suggests that government intervention could extend this bull run into late 2026.

The Best-Case Scenario

Technically, if the price does drop, the best support is likely between $93,000 and $98,000. This aligns with a key moving average that has supported the bull trend for the past year. So, while some short-term volatility is expected, the long-term outlook remains positive.