Bitcoin had a great start to April, hitting $87,000! But it couldn’t keep that momentum and dipped below $84,000 by the weekend. Still, it’s held up better than other cryptos and the stock market, suggesting the bull market might not be over yet.

Why $69,000 is Key for Bitcoin

Analyst Burak Kesmeci looked at Bitcoin’s performance against the backdrop of a shaky overall market. He identified a really important support level: the “Bitcoin Spot ETF Realized Price.”

This basically means the average price people paid for Bitcoin in exchange-traded funds (ETFs). Since ETFs launched in early 2024, this average price has been a strong support level for Bitcoin. Right now, that level is around $69,000. Kesmeci thinks if Bitcoin stays above this, a major crash is unlikely.

When Will Bitcoin’s Bull Run Restart?

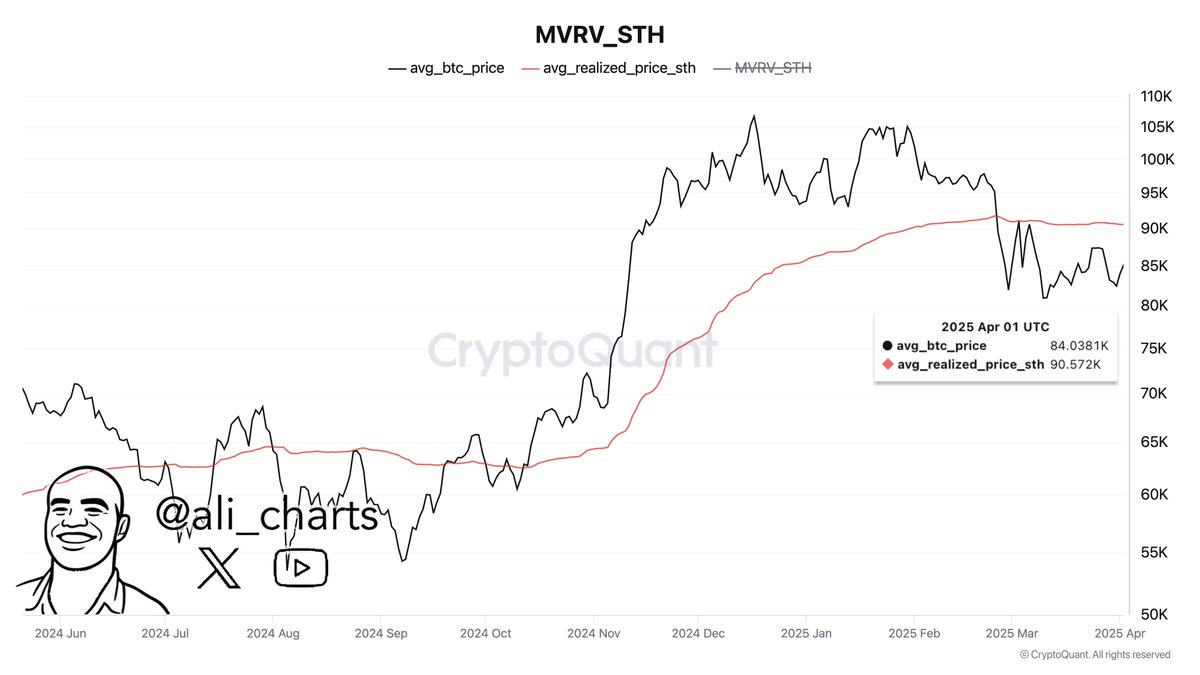

While the ETF realized price is important for preventing a big drop, another metric is key to a new bull run: the short-term holder (STH) realized price.

Analyst Ali Martinez says Bitcoin needs to get back above its STH realized price of $90,570 to signal a renewed bull run. This price has acted as resistance recently. Currently, Bitcoin is trading around $83,900, up slightly in the last 24 hours but down a bit over the last week.