The recent market crash has left Bitcoin hovering below $60,000, exposing several crucial support levels. Crypto analyst Norok has identified $51,800 as the key level Bitcoin must hold to maintain its bullish trend.

Support and Resistance

Norok notes that Bitcoin has fallen below its previous support level of $62,000, which has now become a resistance level. However, he believes that the $51,800 level remains a strong support. If Bitcoin breaks below this level, it could signal a bearish reversal, invalidating the current bullish thesis.

Short-Term Outlook

In the short term, Norok suggests that bulls should aim to hold above $56,900. This level could help to reinforce the bullish trend. He emphasizes that the current price action is a critical moment for Bitcoin.

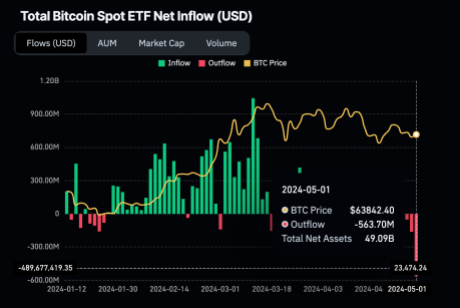

ETF Outflows Impact

One major factor contributing to Bitcoin’s decline has been outflows from Spot Bitcoin ETFs. These outflows have led to increased selling pressure in the market. If outflows continue, Bitcoin could continue to decline and test the $51,800 support level.

Conclusion

While the market crash has caused some uncertainty, Norok believes that Bitcoin’s bullish trend remains intact as long as it holds above $51,800. However, if outflows from Spot Bitcoin ETFs persist, it could put further pressure on Bitcoin’s price.