Ark Invest, a well-known investment firm, believes Bitcoin is on the road to recovery. Their latest report dives into the recent market fluctuations and outlines why they’re still bullish on BTC.

Bitcoin’s Recent Dip and Recovery

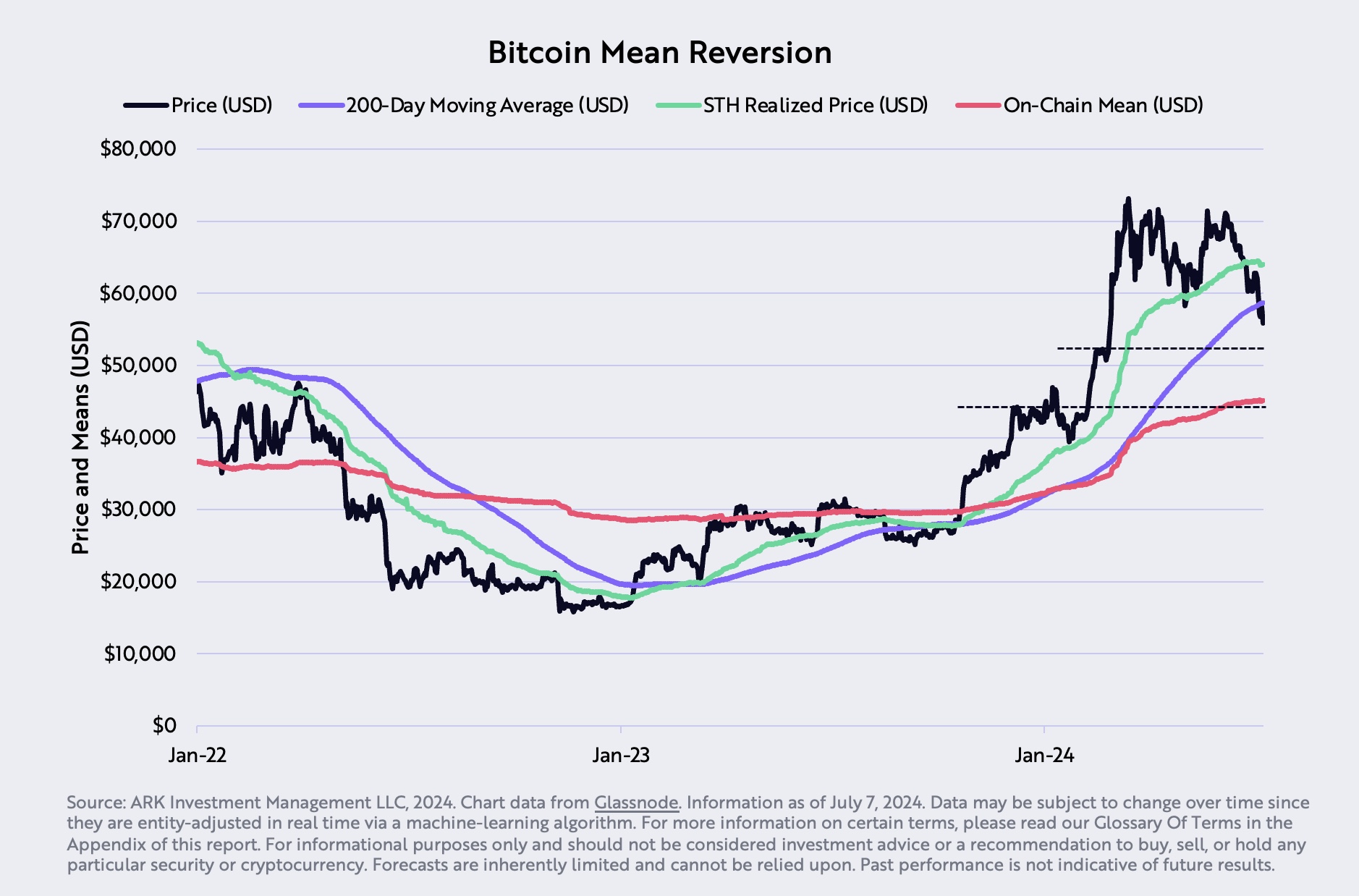

Bitcoin took a tumble in early June, dropping over 25%. This decline even pushed BTC below its 200-day moving average, a key technical indicator that often signals further drops. However, Bitcoin quickly bounced back, proving Ark’s prediction of a recovery correct.

The report points to a large sale of 50,000 Bitcoins by the German government as a contributing factor to the June dip. This sale, which occurred during a period of low market liquidity, put significant downward pressure on the price.

Signs of an Oversold Market

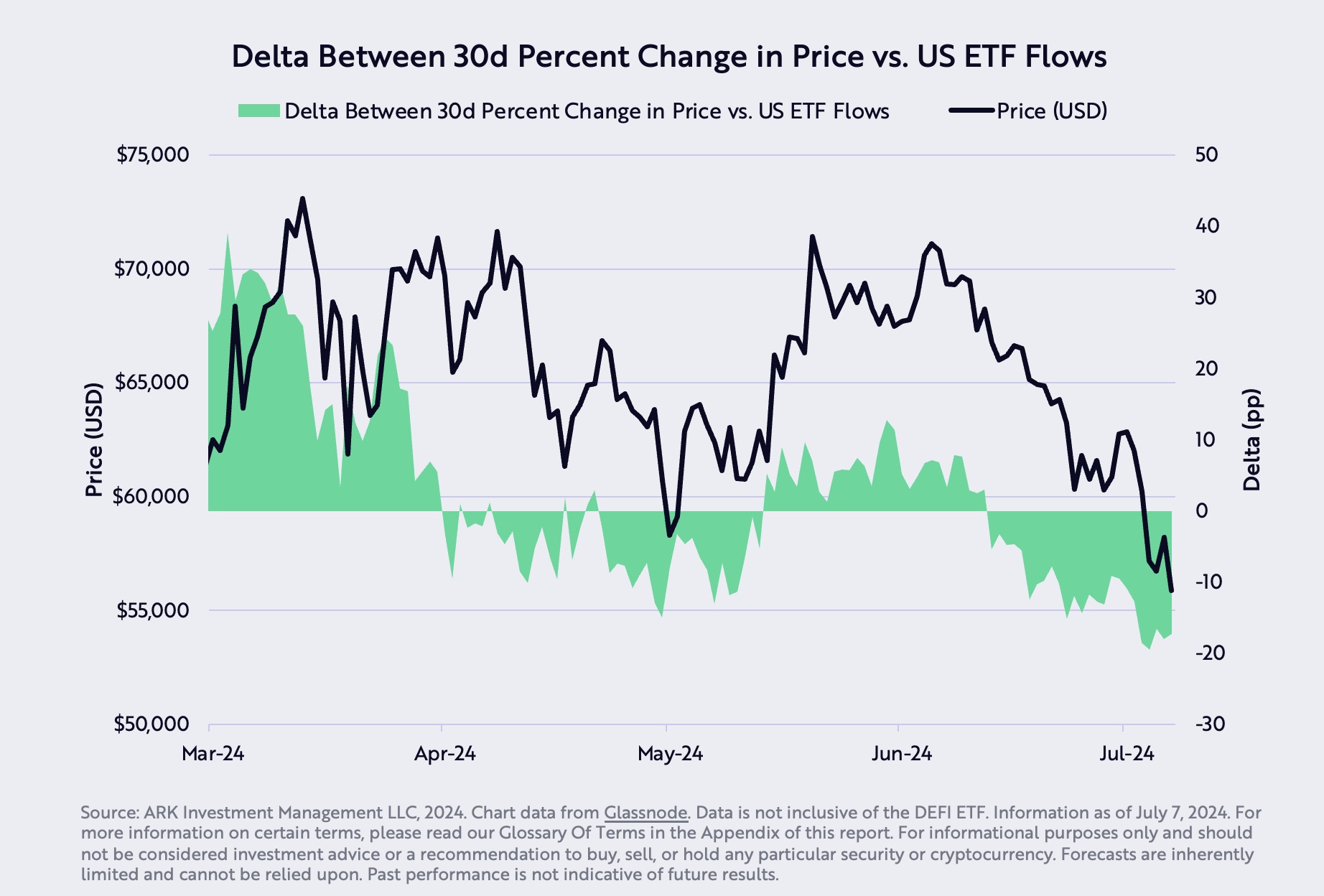

Despite the challenges, Bitcoin has rallied over 17% in recent days. Ark attributes this rebound to several factors:

- Oversold Market: Bitcoin’s price decline was more significant than the drop in US ETF balances, suggesting that the market was oversold.

- Short-Term Holder Losses: Short-term holders, known for their speculative trading, have been realizing losses, which often precedes a market correction.

- Miner Outflows: Bitcoin miners have been selling off their holdings, a pattern often seen before Bitcoin halving events, which historically lead to price increases.

Macroeconomic Factors

The report also highlights macroeconomic factors that could influence Bitcoin’s future:

- US Economic Data: The US economy has been underperforming, with the Bloomberg US Economic Surprise Index showing the most significant negative deviations in a decade.

- Federal Reserve’s Hawkish Stance: The Federal Reserve’s aggressive stance on interest rates could impact investor sentiment and market stability.

- Corporate Profit Squeeze: Companies are facing declining profit margins due to rising costs and reduced pricing power.

- Market Concentration: Equity markets are becoming increasingly concentrated, with larger companies holding more market share. This could signal a shift in the economic landscape.

The Outlook for Bitcoin

Despite the recent volatility, Ark Invest remains optimistic about Bitcoin’s long-term prospects. They believe the recent dip was driven by external factors and that the market is poised for a correction. They also highlight the growing adoption of Bitcoin and its potential as a store of value.

Ark’s analysis suggests that while the road ahead may have some bumps, Bitcoin’s bullish future remains intact.