Is Bitcoin’s price headed down? Recent on-chain data suggests it might be. Let’s dive into what’s happening.

The Coinbase Premium Index Takes a Dive

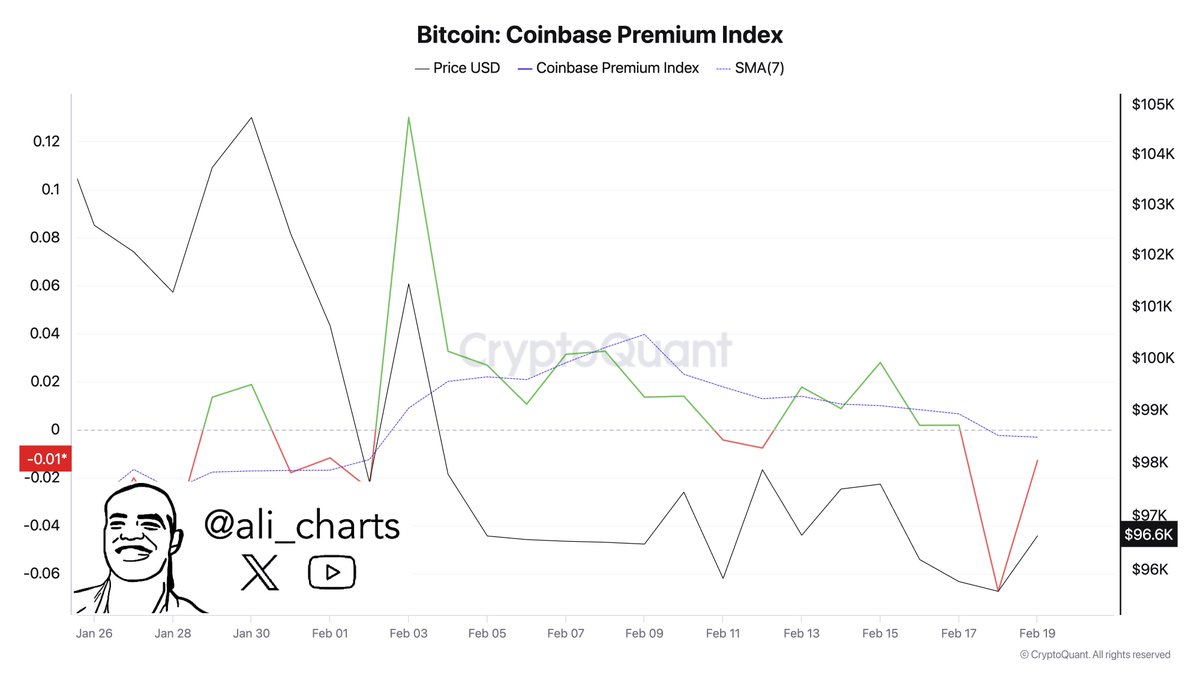

The Bitcoin Coinbase Premium Index, which compares Bitcoin’s price on Coinbase (USD) to Binance (USDT), has fallen below zero. This index is a key indicator of how US institutional investors feel about Bitcoin compared to global investors.

- Positive Index: Means US investors are paying more for Bitcoin than the rest of the world, showing strong US demand.

- Negative Index: Means US investors are paying less, indicating weaker demand. This is what we’re seeing now.

This drop below zero suggests US institutional investors aren’t buying as much Bitcoin as their global counterparts. This is backed up by recent ETF data showing a massive $559 million outflow from US Bitcoin ETFs last week.

Big Bitcoin Holders Are Selling

Adding to the bearish sentiment, large Bitcoin holders (“whales”) have been selling off a significant chunk of their holdings. Data shows whales holding between 10,000 and 100,000 BTC have sold off about 30,000 BTC ($2.9 billion) in the last 10 days. This selling pressure likely contributes to Bitcoin’s recent price stagnation.

What’s Next for Bitcoin?

With US institutional investors showing less interest and whales unloading their Bitcoin, the price of Bitcoin is likely to remain flat or potentially drop further in the short term. While the price is slightly up in the last 24 hours, it’s still down for the week. The overall picture suggests a period of consolidation, or even a downward trend, could be ahead.