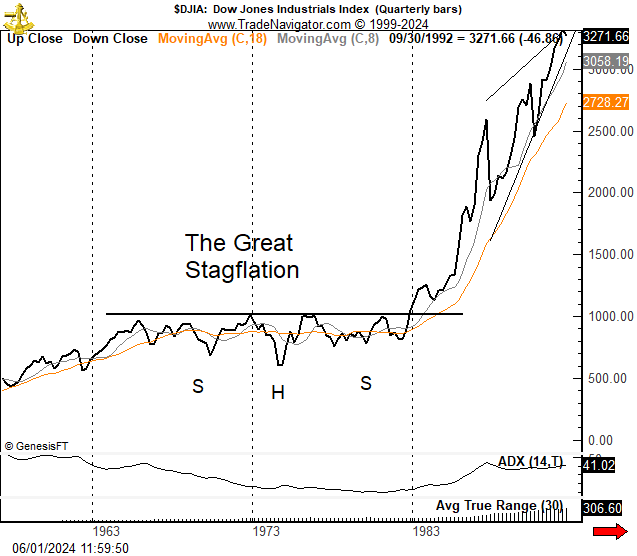

Legendary trader Peter Brandt has identified a striking similarity between Bitcoin’s current chart and the one that preceded a major stock market rally in the 1980s.

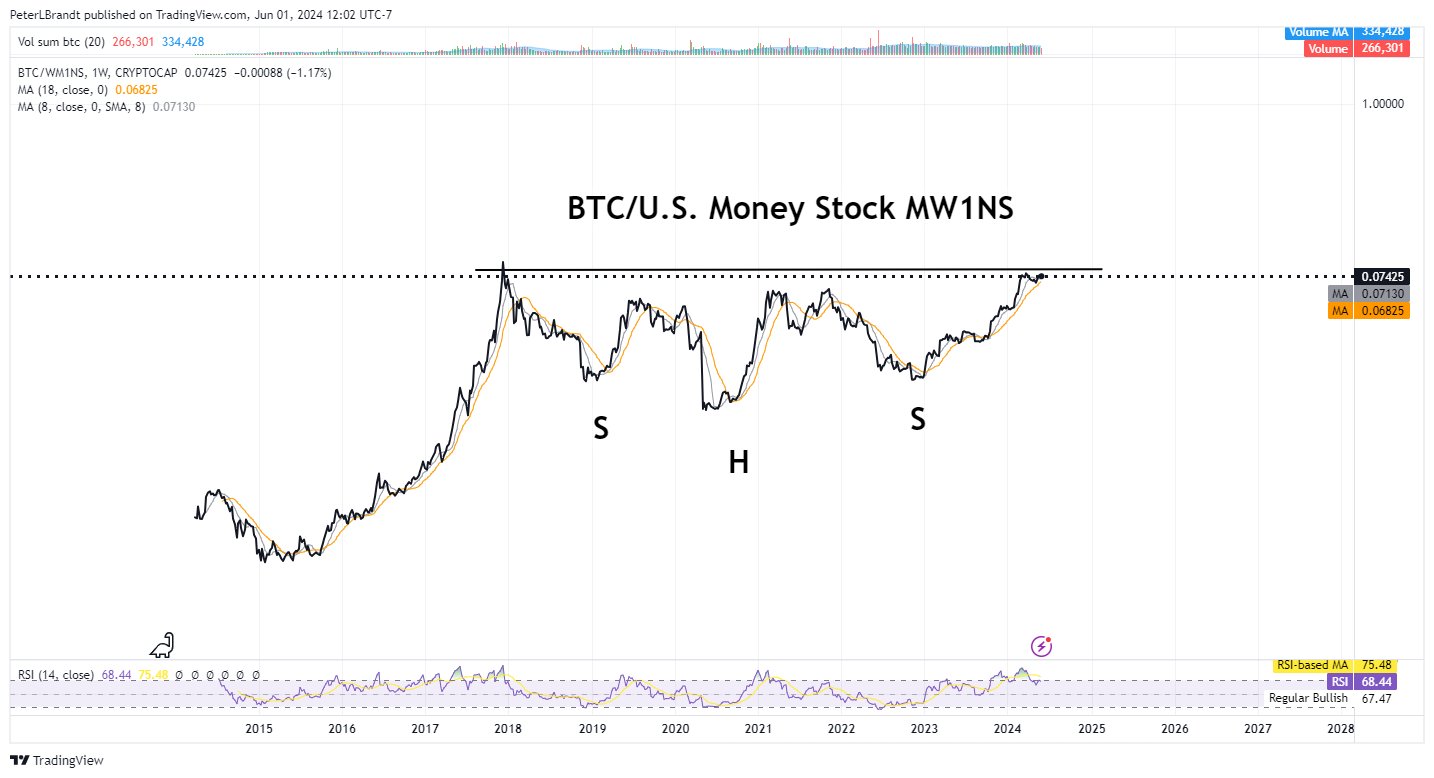

Bitcoin vs. Money Supply

Brandt is comparing Bitcoin’s value to the total amount of money circulating in the US economy (M1). He believes this ratio suggests that Bitcoin is undervalued compared to its 2017 peak.

Inverted Head and Shoulders Pattern

Brandt also points to an inverted head and shoulders pattern in the BTC/WM1NS chart. This pattern indicates that buyers are regaining control and may lead to a breakout.

Bitcoin to Outperform Gold

Brandt predicts that Bitcoin will continue to rise against gold in the coming months. He believes the ratio of gold ounces needed to buy one Bitcoin will eventually reach 100 ounces.

Implications for Bitcoin Price

Based on Brandt’s analysis, Bitcoin could potentially reach over $230,000 if the BTC/WM1NS ratio hits his target.

Disclaimer

This information is for informational purposes only and should not be considered investment advice.