Bitcoin has been on a roll lately, surging over 11% since Tuesday after the Federal Reserve announced a rate cut. This news gave investors a boost, pushing Bitcoin past the $60,000 mark – a psychologically important level that signaled a shift in market sentiment.

Bitcoin Liquidity Above $65,000

Now, Bitcoin is testing new highs, and analysts are watching closely. Data shows that a lot of Bitcoin liquidity is concentrated above $65,000, with a major cluster around $70,000. This means there’s a lot of potential for price swings as traders buy and sell.

Think of it like this: imagine a lot of people are holding onto Bitcoin, but they’re willing to sell if the price reaches a certain point. This is what creates liquidity – the ability for the price to move quickly.

$70,000: A Key Target

Traders are watching these liquidity levels closely, as they could trigger a big move in the price. If Bitcoin breaks through these levels, it could signal a strong upward trend, potentially pushing Bitcoin to new all-time highs.

Bitcoin’s Price Levels to Watch

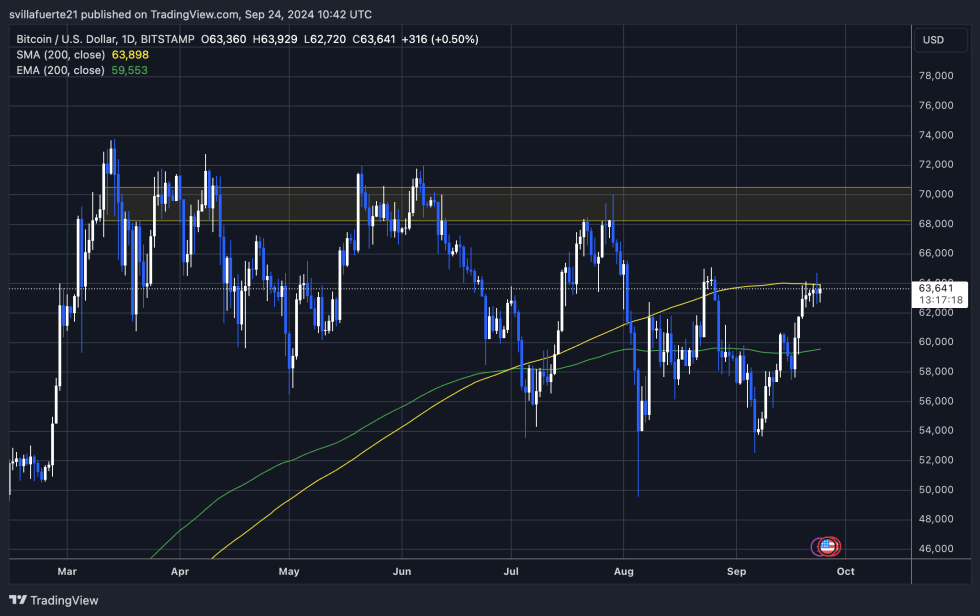

Bitcoin is currently trading around $63,641, just below a key technical indicator called the 200-day moving average. This indicator is important because it represents long-term strength. Bitcoin has struggled to break above this level, but it hasn’t dropped significantly either, suggesting a breakout could be imminent.

Many investors believe Bitcoin will soon reclaim the 200-day moving average and the $65,000 mark, which could fuel further upward momentum. However, there’s still a chance that Bitcoin could dip back down to $60,000 before pushing higher.

Traders are watching closely to see which way the market will go. If Bitcoin breaks above the 200-day moving average, it could be a strong signal of a bullish trend. But if it dips below $60,000, it could signal a short-term correction.