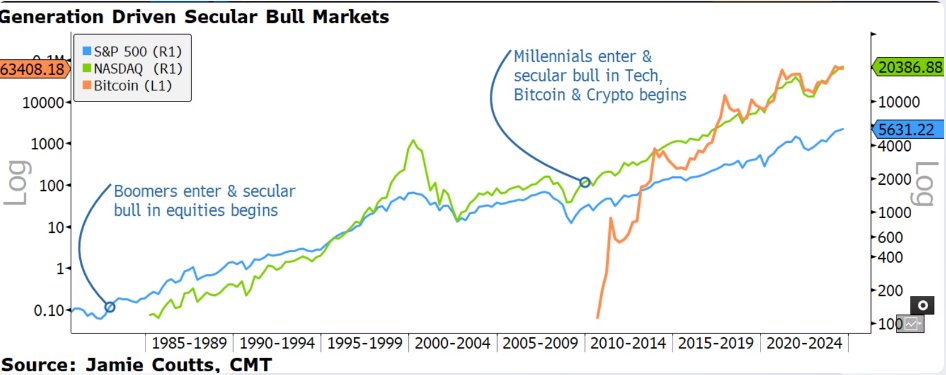

Crypto analyst Jamie Coutts believes that Bitcoin and other digital assets are still in the early stages of a massive bull market. He thinks that Bitcoin adoption will continue to grow for decades, similar to how the NASDAQ stock market exploded in popularity.

Bitcoin: The New NASDAQ?

Coutts compares Bitcoin’s launch in 2009 to the NASDAQ’s launch in the 1970s. He says that Bitcoin is to millennials what the NASDAQ was to baby boomers.

“The NASDAQ took a while to become a serious investment option,” he explains. “It wasn’t until the mid-1980s that it really took off. Bitcoin is going through a similar process. It’s only now starting to become mainstream.”

Bitcoin’s Hashrate is a Bullish Sign

Coutts is also keeping a close eye on Bitcoin’s hashrate, which is a measure of the computing power used to secure the Bitcoin network. He sees a recent increase in hashrate as a positive sign for Bitcoin’s price.

“The hashrate is recovering after a dip following the last Bitcoin halving,” he says. “This means the network is getting stronger, which is good news for the price.”

Investing in Bitcoin: A Long-Term Play

Coutts advises investors to think long-term when it comes to Bitcoin. He sees it as a low-risk way to hedge against inflation and a bet on the future of technology.

“This bull market has a long way to go,” he says. “Don’t get caught up in the short-term fluctuations. Look at the bigger picture.”