The recent dip in Bitcoin’s price has some investors worried, but CryptoQuant CEO Ki Young Ju isn’t one of them. He believes we’re still in the middle of a bull market, and there’s good reason to be optimistic.

Why Ki Young Ju is Bullish on Bitcoin

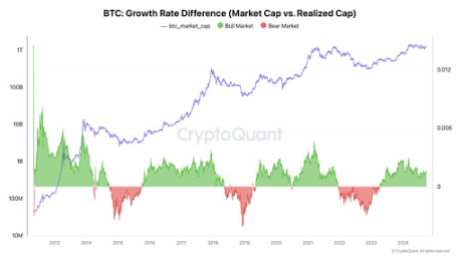

Ki Young Ju’s confidence isn’t just based on gut feeling. He’s looking at the numbers, specifically the difference between Bitcoin’s market cap and its realized cap.

- Market cap: This is the total value of all Bitcoins in circulation, calculated by multiplying the current price by the total supply.

- Realized cap: This takes into account the actual price paid for each Bitcoin based on the last time it was moved.

When the market cap grows faster than the realized cap, it suggests that the average Bitcoin is trading at a higher price than it was when it last moved. This is a bullish signal.

Ki Young Ju has noticed this trend in Bitcoin’s growth rate difference, and he says it typically lasts for about two years. Since it started in late 2023, we could be in for a long bull run.

What This Means for Bitcoin

Based on historical trends, Bitcoin could continue its bull run for at least another year. Plus, there are other positive signs:

- Institutional investors are pouring money into Bitcoin. Spot Bitcoin ETFs, which allow institutional investors to invest in Bitcoin directly, saw huge inflows last week and are continuing to attract investment.

- The fundamentals for Bitcoin are strong. With increasing institutional interest and a growing number of users, Bitcoin’s future looks bright.

Even though Bitcoin dipped below $65,000 recently, Ki Young Ju remains optimistic. The bull market isn’t over yet, and there’s still plenty of room for growth. /p>