CryptoQuant’s CEO, Ki Young Ju, is ringing the alarm bell: he believes Bitcoin’s bull market is finished. He’s predicting a bearish or sideways market for the next 6 to 12 months.

The Warning Signs

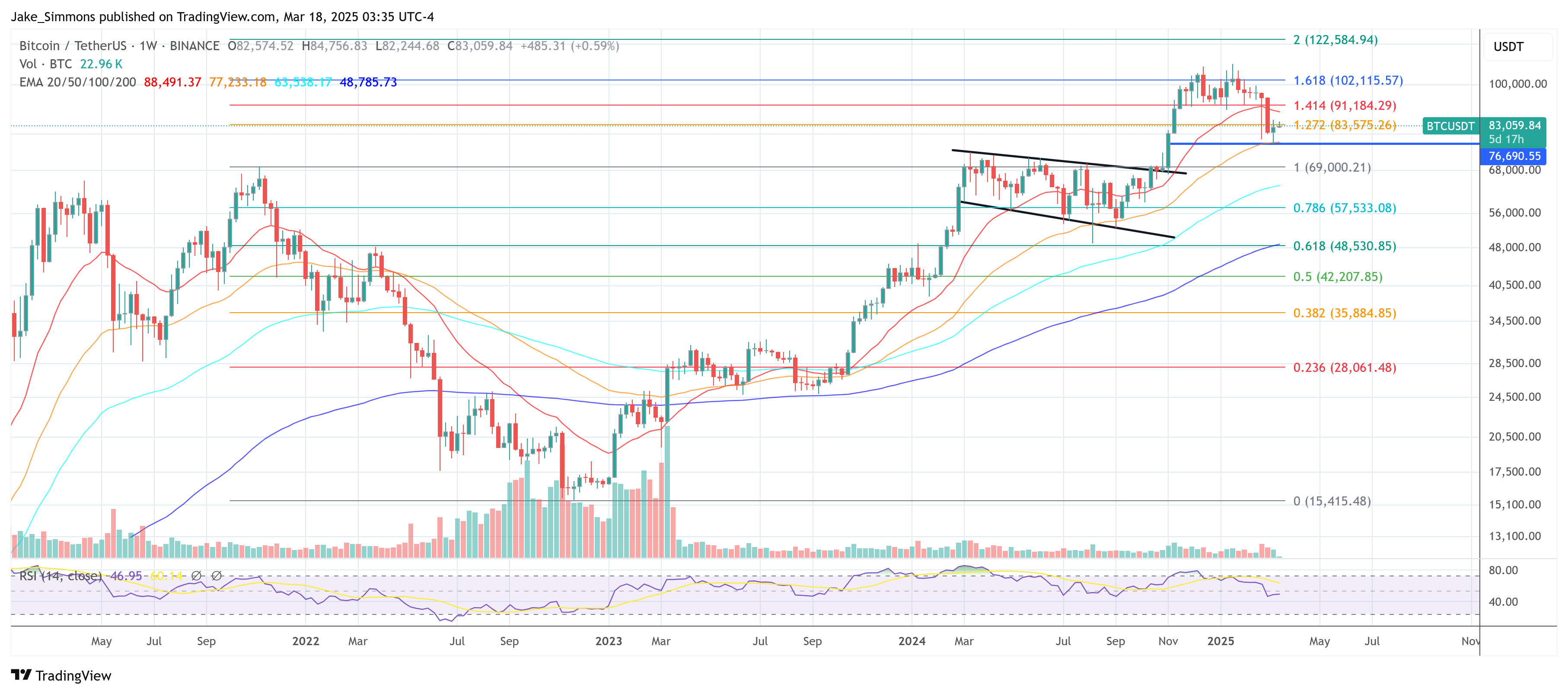

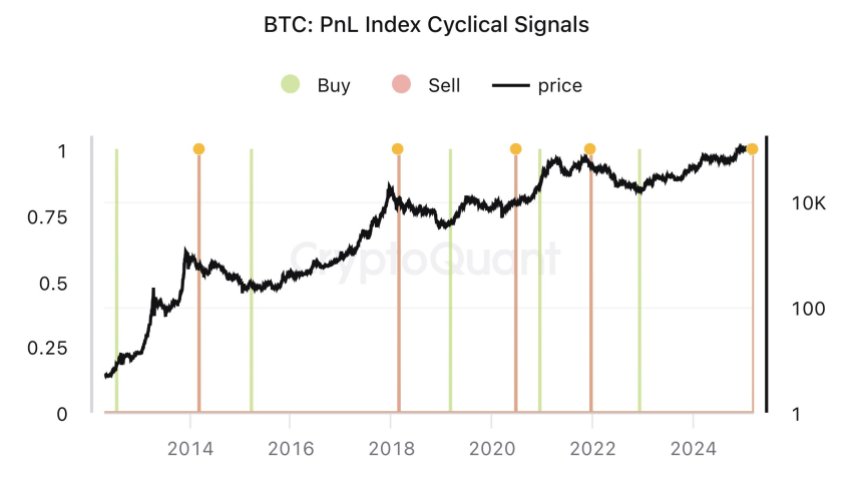

This prediction comes as a surprise to some, as just a couple of weeks ago, Ki was more optimistic. His change of heart is based on his company’s on-chain analysis. Specifically, he’s looking at the Bitcoin PnL Index Cyclical Signals. This index combines various metrics to identify market peaks and troughs. According to Ki, this index historically provides accurate buy/sell signals.

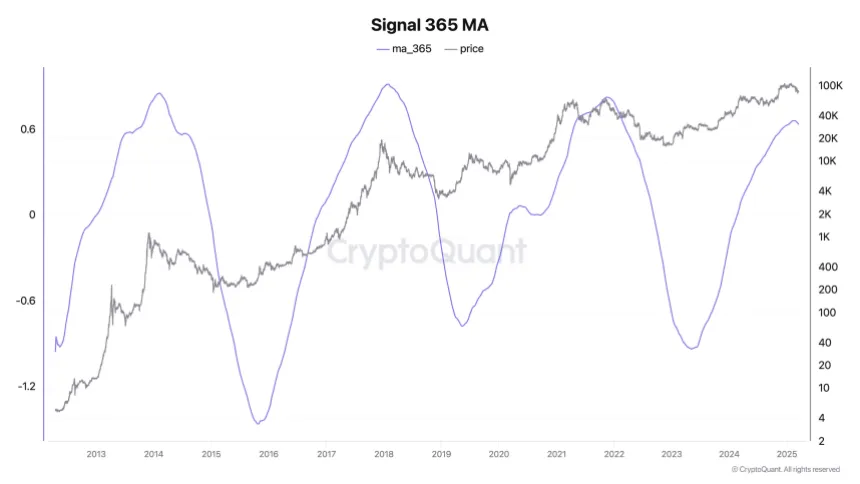

He explained that an automated alert, sent to CryptoQuant subscribers, uses a 365-day moving average of these metrics. A change in this average often signals a major shift in the market. He shared a chart illustrating this, highlighting how the alert system works.

Drying Liquidity and Whale Activity

Ki points to two key factors: drying liquidity and new “whales” (large investors) selling Bitcoin at lower prices. He notes that his subscribers received this alert days before the public announcement and likely adjusted their positions accordingly.

A Shift in Sentiment

This announcement is a significant shift from Ki’s previous statements. Just a few days earlier, he was more cautious but still hesitant to declare a bear market. Even two weeks prior, he believed the bull cycle was still alive, citing strong fundamentals and increased mining capacity. However, he acknowledged then that negative sentiment, particularly in the US, could change things. Now, that warning has become a stark reality. He even humorously noted that nobody – not even Donald Trump – wants the bull market to end.

The Bottom Line

Ki’s prediction paints a picture of a potentially lengthy period of stagnant or declining Bitcoin prices. At the time of this writing, Bitcoin was trading at $83,059. Whether his prediction is accurate remains to be seen, but his warning is a significant development for Bitcoin investors.