Economic Cycles and Asset Performance

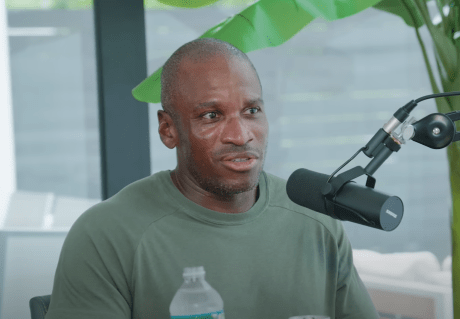

Arthur Hayes, co-founder of BitMEX, draws parallels between the economic upheavals of the 1930s-1970s and today’s financial landscape. He categorizes these cycles into:

- Local Cycles: Focus on national protectionism and financial repression, leading to inflation.

- Global Cycles: Encourage global trade and investment, resulting in deflation.

Bitcoin’s Emergence in a Local Cycle

Hayes argues that Bitcoin’s creation in 2009 coincided with a renewed Local cycle, characterized by a global recession and central bank interventions. Similar to gold in the 1930s, Bitcoin’s decentralized and state-independent nature makes it a safe haven during economic uncertainty and inflation.

Fiscal Indicators and Bitcoin’s Value

Hayes points to the significant US budget deficit as an indicator of fiscal expansion similar to past Local cycles. This suggests that government spending and monetary policies will continue to support the value of Bitcoin.

Conclusion

Hayes believes that the same dynamics that drove the value of gold in the past are now aligning to bolster Bitcoin’s value. He recommends holding crypto as a way to preserve wealth in the face of currency devaluation and fiscal instability.