Bitcoin is on the rise, and some analysts believe we’re entering the most exciting part of the bull run.

A $133,000 Target?

Crypto analyst Tony Severino thinks Bitcoin could hit a whopping $133,000 in this bull run. He’s looking at a technical indicator called the Relative Strength Index (RSI), which has historically signaled the start of major price surges. In past bull runs, the RSI reaching 70 led to massive gains:

- 2012: 11,000% price increase

- 2016:

2,700% price increase

2,700% price increase - 2020: 437% price increase

Severino believes that each bull run peak has been about 20% higher than the previous one. Based on this, a 20% increase from the 2021 bull run peak could put Bitcoin at $133,000. That’s a potential return of 87% for those buying Bitcoin at its current price.

Another Analyst Sees Even Higher Potential

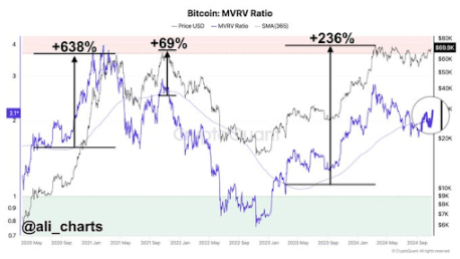

Another analyst, Ali Martinez, is even more bullish. He’s looking at the Market Value To Realized Value (MVRV) ratio, which has historically signaled big bull rallies. He believes the recent crossing of the 365-day Simple Moving Average (SMA) is a strong indicator of a major price surge. In the past, this “golden cross” led to a 236% price increase for Bitcoin.

Martinez also sees Bitcoin potentially reaching between $174,000 and $462,000 based on historical patterns.

The Bottom Line

While predictions vary, many experts agree that Bitcoin is headed for a significant price increase. Some even believe it could break through $100,000 this year.

It’s important to remember that crypto markets are volatile, and no one can predict the future with certainty. However, the current indicators and analyst sentiment suggest that Bitcoin’s bull run is far from over. /p>